The business model of life insurance is based on the long term: the maturities of the policies are on average about 25 years. For investors, this means stable yields over a longer period of time.

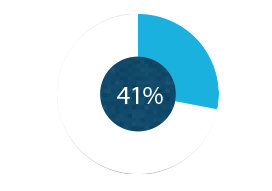

Life insurance, in terms of premiums, is the second-largest insurance line in the UNIQA Group. It includes savings products such as classic or unit-linked life insurance. There are also biometric products to secure against such risks as occupational disability, nursing, or death. In life insurance, we cleared €2.5 billion in premiums written across the Group in 2014; this was about 41 per cent of total premium volume.

More necessary than ever – life insurance

Total

|

Broad coverage // |

CEE

|

Growth opportunities // |

Fundamentals of life insurance

Life insurance covers economic risks that stem from the uncertainty as to how long a customer will live. The insured event is the attainment of a certain point in time, or the death of the insured during the insurance period. The customer or another authorised beneficiary then receives a capital sum or an annuity. The premium is calculated on the basis of the principle of equivalence: its amount conforms to the type of insurance, age at the time the contract was formed, the policy term and the duration of premium payments.

Long-term investment with rising demand

The life insurance business model is oriented towards the long term: policy terms are around 25 years on average. For our investors, this means stable income over a longer period of time. The cancellation rates in this field are moderate: between three and five per cent in Austria, and ten per cent in CEE.

Private provisions have never been so important as now. Life expectancy is increasing and the pension systems of many European countries are being pushed to their limits. In Austria, we can expect people to start rethinking their long-term financial planning because of the online pension account: if people become aware of the pension gap – the difference between their last paycheck and their pension – then the demand for additional security will grow. We are also seeing a strong need for security among investors and a lack of attractive alternatives in the investment market.

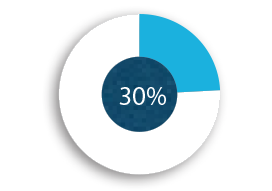

The CEE region also offers growth potential in terms of life insurance. The constantly improving standard of living in CEE is leading to an increase in demand for additional insurance products. While the early focus in many markets was on the motor vehicle insurance business, more and more savings and investment products are being offered in the form of life insurance.

Old-age provision: Demand is growing with the rising life expectancy

|

57.5 years 18.3% 22.5 years 11 years €1,053 27.9% Sources: Statistics Austria, Austrian Economic Chambers, Main Association of Austrian Social Security Organisations |

New model in Austria

The conventional life insurance model is currently facing major challenges in Central Europe. Historically low yield levels are adversely affecting all long-term forms of saving and investment, and therefore also life insurance. To meet the requirements of Solvency II, policies with guaranteed interest rates will require relatively high levels of equity. In addition, the conventional life insurance model is increasingly coming under criticism from consumer protection agencies.

We were the first insurance company in Austria to respond to these developments. In December 2014, UNIQA Austria and Raiffeisen Versicherung AG introduced a new model for classic life insurance to the market. It is flexible and transparent, and the costs are distributed fairly. The product does away with the discount rate, but offers a 100 per-cent capital guarantee on net premiums and high repurchase values from the beginning.

This new life insurance brings customer needs, the requirements of the capital market and of the regulatory environment down to one common denominator. From the beginning, customers receive a significantly higher savings premium because costs and fees are taken from earnings. This means that the full premium flows into the investment. For UNIQA, this new model requires lower capital backing, and capital requirements decrease, depending on the policy term and interest level.

|

Life insurance New // |

Confront challenges, expand product portfolio

We are expanding our portfolio management in order to increase the profitability of the life insurance line of business. For life insurance to remain attractive to our customers, we also need the right structural conditions, along with solid product and cost management. Policymaking and regulatory authorities need to create the foundation for this in terms of taxation and regulations.

Unit-linked life insurance will be a priority, along with the new classic life insurance product. Our objective is to offer our customers flexible solutions for whatever circumstances they may find themselves in. We are also following the general trend in the insurance industry towards biometric products.