UNIQA Group at a glance

Consolidated key figures

In € million |

2016 |

2015 |

Change |

||||||||

|

|||||||||||

Premiums written |

4,643.1 |

4,829.0 |

–3.9% |

||||||||

Savings portions from unit-linked and index-linked life insurance (before reinsurance) |

405.1 |

382.0 |

+6.0% |

||||||||

Premiums written including savings portions from unit-linked and index-linked life insurance |

5,048.2 |

5,211.0 |

–3.1% |

||||||||

of which property and casualty insurance |

2,518.4 |

2,439.2 |

+3.2% |

||||||||

of which health insurance |

1,003.7 |

964.4 |

+4.1% |

||||||||

of which life insurance |

1,526.1 |

1,807.5 |

–15.6% |

||||||||

of which recurring premiums |

1,356.9 |

1,366.9 |

–0.7% |

||||||||

of which single premiums |

169.2 |

440.6 |

–61.6% |

||||||||

Premiums written including savings portions from unit-linked and index-linked life insurance |

5,048.2 |

5,211.0 |

–3.1% |

||||||||

of which UNIQA Austria |

3,631.5 |

3,883.5 |

–6.5% |

||||||||

of which UNIQA International |

1,399.9 |

1,302.8 |

+7.5% |

||||||||

of which reinsurance |

1,130.8 |

1,112.1 |

+1.7% |

||||||||

of which consolidation |

–1,113.9 |

–1,087.3 |

+2.4% |

||||||||

|

|

|

|

||||||||

Premiums earned (net)1) |

4,443.0 |

4,651.1 |

–4.5% |

||||||||

of which property and casualty insurance |

2,359.1 |

2,301.3 |

+2.5% |

||||||||

of which health insurance |

1,000.4 |

963.9 |

+3.8% |

||||||||

of which life insurance |

1,083.6 |

1,386.0 |

–21.8% |

||||||||

Savings portions from unit-linked and index-linked life insurance (after reinsurance) |

384.7 |

365.9 |

+5.1% |

||||||||

Premiums earned including savings portions from unit-linked and index-linked life insurance |

4,827.7 |

5,017.0 |

–3.8% |

||||||||

|

|

|

|

||||||||

Net insurance benefits |

–3,385.6 |

–3,671.3 |

–7.8% |

||||||||

of which property and casualty insurance |

–1,550.6 |

–1,553.7 |

–0.2% |

||||||||

of which health insurance |

–843.6 |

–781.7 |

+7.9% |

||||||||

of which life insurance |

–991.4 |

–1,335.9 |

–25.8% |

||||||||

|

|

|

|

||||||||

Operating expenses (net)2) |

–1,286.4 |

–1,190.4 |

8.1% |

||||||||

of which property and casualty insurance |

–763.2 |

–699.6 |

+9.1% |

||||||||

of which health insurance |

–175.5 |

–153.7 |

+14.2% |

||||||||

of which life insurance |

–347.7 |

–337.1 |

+3.1% |

||||||||

Cost ratio (net after reinsurance) |

26.6% |

23.7% |

– |

||||||||

|

|

|

|

||||||||

Combined ratio (net after reinsurance) |

98.1% |

97.9% |

– |

||||||||

|

|

|

|

||||||||

Net investment income |

588.9 |

732.0 |

–19.5% |

||||||||

|

|

|

|

||||||||

Profit/loss on ordinary activities |

225.5 |

397.8 |

–43.3% |

||||||||

Net profit/loss |

149.6 |

340.7 |

–56.1% |

||||||||

Consolidated profit/loss |

148.1 |

337.2 |

–56.1% |

||||||||

|

|

|

|

||||||||

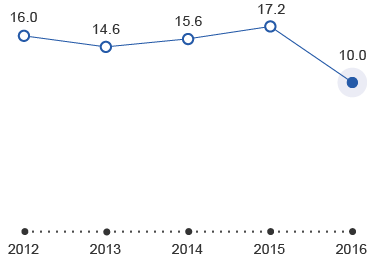

Operating return on equity |

10.0% |

17.2% |

– |

||||||||

|

|

|

|

||||||||

Investments3) |

25,454.6 |

29,416.1 |

–13.5% |

||||||||

Shareholders’ equity |

3,186.3 |

3,144.5 |

+1.3% |

||||||||

Equity including non-controlling interests |

3,212.8 |

3,166.4 |

1.5% |

||||||||

Technical provisions (net)4) |

21,812.7 |

25,638.9 |

–14.9% |

||||||||

Total assets |

33,639.2 |

33,297.9 |

1.0% |

||||||||

|

|

|

|

||||||||

Number of insurance contracts |

18,785,051 |

19,254,690 |

–2.4% |

||||||||

Average number of employees |

12,855 |

13,782 |

–6.7% |

||||||||

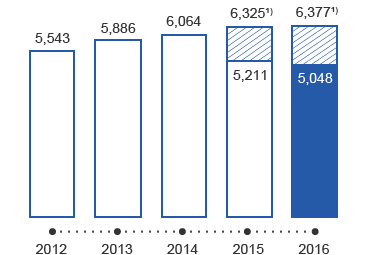

Premiums written

In € million

1) Including Italy

(Including savings portions from unit-linked and index-linked life insurance)

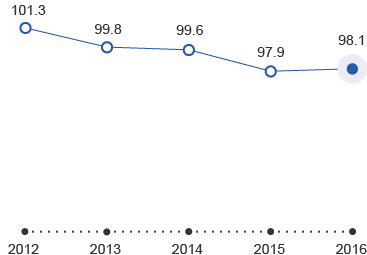

Combined ratio

In percent

(After reinsurance)

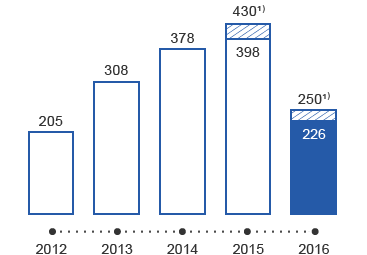

Earnings before taxes

In € million

1) Including Italy

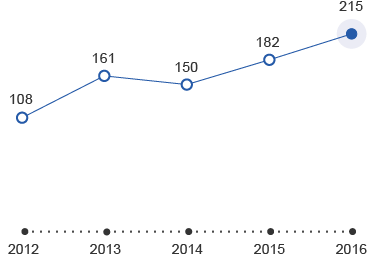

Economic capital ratio (ECR ratio)

In percent

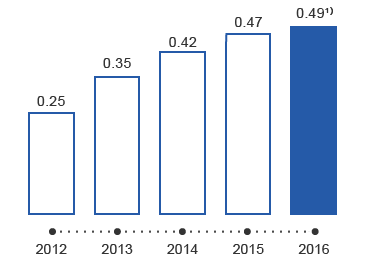

Dividend per share

In €

1) Proposal to the Annual General Meeting

Operating return on equity

In percent

Definitions of the essential key figures can be found in the glossary.

In € million |

2012 |

2013 |

2014 |

2015 |

2016 |

||

|

|||||||

Premiums written, including savings portions from unit-linked and index-linked life insurance |

5,543 |

5,886 |

6,064 |

5,211 |

5,048 |

||

of which property and casualty insurance |

2,546 |

2,591 |

2,621 |

2,439 |

2,518 |

||

of which health insurance |

909 |

938 |

961 |

964 |

1,004 |

||

of which life insurance |

2,088 |

2,357 |

2,483 |

1,807 |

1,526 |

||

Insurance benefits (net) |

–3,759 |

–3,959 |

–4,384 |

–3,671 |

–3,386 |

||

of which property and casualty insurance |

–1,639 |

–1,634 |

–1,724 |

–1,554 |

–1,551 |

||

of which health insurance |

–756 |

–769 |

–781 |

–782 |

–844 |

||

of which life insurance |

–1,363 |

–1,557 |

–1,880 |

–1,336 |

–991 |

||

Operating expenses (net) |

–1,319 |

–1,354 |

–1,299 |

–1,190 |

–1,286 |

||

of which property and casualty insurance |

–787 |

–803 |

–749 |

–700 |

–763 |

||

of which health insurance |

–139 |

–162 |

–167 |

–154 |

–175 |

||

of which life insurance |

–394 |

–389 |

–383 |

–337 |

–348 |

||

Combined ratio after reinsurance (in per cent) |

101.3% |

99.8% |

99.6% |

97.9% |

98.1% |

||

Claims rate (in per cent) |

68.4% |

66.9% |

69.4% |

67.5% |

65.7% |

||

Cost ratio (in per cent) |

32.9% |

32.9% |

30.2% |

30.4% |

32.4% |

||

Net investment income |

791 |

780 |

888 |

732 |

589 |

||

Earnings before taxes |

204 |

308 |

378 |

398 |

226 |

||

of which property and casualty insurance |

–12 |

47 |

61 |

71 |

58 |

||

of which health insurance |

103 |

84 |

130 |

171 |

96 |

||

of which life insurance |

113 |

177 |

187 |

155 |

72 |

||

Consolidated profit/(loss) |

127 |

285 |

290 |

337 |

148 |

||

Earnings per share (in €) |

0.75 |

1.21 |

0.94 |

1.09 |

0.48 |

||

Dividend per share (in €) |

0.25 |

0.35 |

0.42 |

0.47 |

0.491) |

||

Equity (portion attributable to shareholders of UNIQA Insurance Group AG) |

2,009 |

2,763 |

3,082 |

3,145 |

3,186 |

||

Total assets |

30,055 |

31,002 |

33,038 |

33,298 |

33,639 |

||

Operating return on equity (in per cent) |

16.0% |

14.6% |

15.6% |

17.2% |

10.0% |

||

Economic capital ratio – ECR ratio (in per cent) |

108% |

161% |

150% |

182% |

215% |

||