An attractive investment

The economic environment remained very challenging in 2016. Our Group’s steady business development nevertheless allows a further dividend increase to €0.49 per share. UNIQA is an interesting investment option in other ways too, with a strong brand, good market positioning, enduringly successful partnerships and solid capital resources.

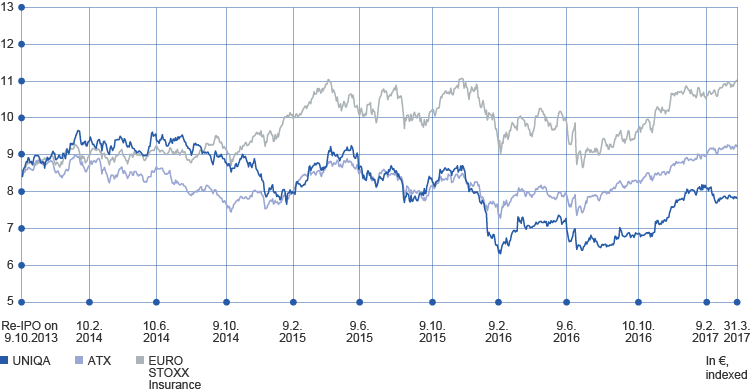

The leading European index Euro Stoxx 50 increased by 0.7 per cent to 3,290.52 points in 2016. Including distributed dividends, a total return of 5.0 per cent was attained. Over the course of the year, only the Brexitvote and the presidential elections in the USA managed to cast a dark cloud, albeit short-term, over the development of share prices. The index profited particularly from the sound performance of the banks in the second half of the year.

European insurance values fell by about 6.0 per cent in comparison to the 2016 leading index, due to the low-interest environment. After dividend distributions, however, the difference was only 1.6 per cent. Among the greatest losers in 2016 were Italian insurers, a development attributable primarily to their proximity to the Italian banking sector, which by year-end was relying increasingly on restructuring measures.

The Vienna Stock Exchange – in alignment with international share price performance – made a slow start in 2016: the ATX leading index even fell below the 2,000-point mark and reached its lowest value of the year in mid-February. The subsequent recovery phase was interrupted again by the Brexit turbulence, and the ATX sank again below 2,000 points. From the middle of the year, however, a powerful upward surge began, based on favourable fundamental company data and positive economic developments in the expanded domestic market in Central and Eastern Europe. By the end of 2016, the ATX had climbed 9.2 per cent over its high point of the previous year to 2,618.43 points. This was the highest year-end figure since 2010.

In € |

2012 |

2013 |

2014 |

2015 |

2016 |

||

|

|||||||

UNIQA share price as at 31 December |

9.86 |

9.28 |

7.78 |

7.53 |

7.20 |

||

High |

13.40 |

11.14 |

10.02 |

9.41 |

7.45 |

||

Low |

8.75 |

8.12 |

7.34 |

7.04 |

5.04 |

||

Average daily turnover (in € million) |

0.1 |

1.5 |

3.2 |

4.5 |

5.2 |

||

Market capitalisation as at 31 December (in € million) |

1,672.3 |

2,183.5 |

2,397.6 |

2,320.6 |

2,218.5 |

||

Average number of shares in circulation |

169,599,813 |

235,294,119 |

308,180,350 |

308,180,350 |

308,129,721 |

||

Earnings per share |

0.75 |

1.21 |

0.94 |

1.09 |

0.48 |

||

Dividend per share |

0.25 |

0.35 |

0.42 |

0.47 |

0.491) |

||

UNIQA shares, which are listed in the prime market of the Vienna Stock Exchange have since 2014 also been listed in Austria’s leading ATX index, after the successful re-IPO in October 2013 and the resulting sharp increase in liquid funds. The share price declined noticeably in early 2016 and reached its low point for the year on 11 February 2016 at €5.04. In addition to general market developments, the announcement of an investment and innovation programme on 18 January 2016 also had an effect. By early June 2016, the UNIQA share price had recovered to over €6.50, after which it fell slightly. By the end of October 2016, the price was oscillating between €5.20 and €6.10.

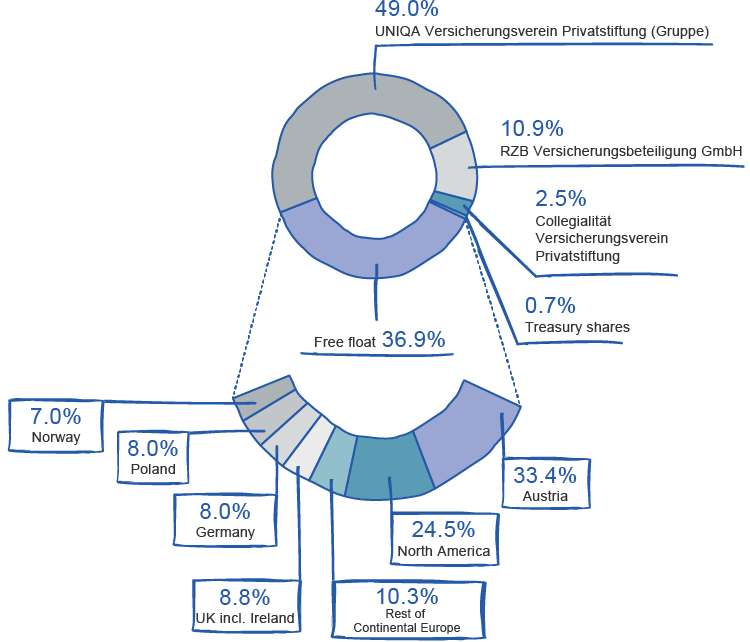

Shareholder structure

Equity story

- Austria’s strongest insurance brand

- Comprehensive sales platforms

- Market leader in health insurance

- Successful sales partnershipwith Raiffeisen

- Interesting growth potential in CEE

- Solid capital position

- Attractive dividend policy

From there on it climbed steeply upwards, reaching €7.28 on 28 December 2016. At year-end, UNIQA shares stood at €7.20. At the beginning of 2017, the share price rose, reaching €7.83 on 1 February 2017. On 31 March 2017, the share price was €7.28.

UNIQA shares posted an overall deterioration in price of 4.4 per cent over the course of 2016 – while the benchmark index for the European insurance industry, EURO STOXX Insurance, lost 2.1 per cent in the same period of time, with some competitors even reporting double-digit percentage drops.

Research

The following investmentbanks currently publish regular research reports on UNIQA shares:

- Berenberg Bank

- Commerzbank

- Deutsche Bank

- Erste Group Bank

- J.P. Morgan

- Keefe, Bruyette & Woods

- Kepler Cheuvreux

- Raiffeisen Centrobank

- UBS

Change in the shareholder structure

The sale of a package of shares in UNIQA Insurance Group AG to UNIQA Versicherungsverein Privatstiftung, as announced in July 2016 by Raiffeisen Zentralbank Österreich AG, was legally executed on 15 December 2016 after approval by the relevant authorities. This means that the core shareholder UNIQA VersicherungsvereinPrivatstiftung (Group) now holds 49.0 per cent of UNIQA shares (Austria Versicherungsverein Beteiligungs-Verwaltungs GmbH:41.3 per cent, UNIQA Versicherungsverein Privatstiftung: 7.7 per cent). Raiffeisen Bank International AG now holds only 10.9 per cent through RZB Versicherungsbeteiligung GmbH as a core shareholder. The core shareholder Collegialität Versicherungsverein Privatstiftung still holds 2.5 per cent of UNIQA shares. The Company’s portfolio of treasury shares remains at 0.7 per cent. The free float increased slightly due to the transaction and amounted to 36.9 per cent by the end of 2016, more than one third of total shares. On 31 December 2016, market capitalisation based on the free float amounted to approximately €823 million.

Because of their pooled voting rights, shareholdings of UNIQA Versicherungsverein Privatstiftung, Austria Versicherungsverein Beteiligungs-Verwaltungs GmbH, Collegialität Versicherungsverein Privatstiftung and RZB Versicherungsbeteiligung GmbH are counted together. Reciprocal purchase option rights were agreed.

UNIQA share performance

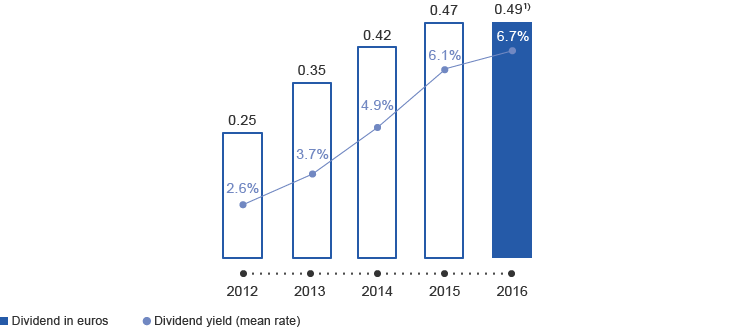

Progressive dividend policy

One of our prime concerns is to ensure that UNIQA’s shareholders participate in the success of the Company to an appropriate extent. To this effect, dividend distributions have been raised consistently over recent years. On the basis of the separate financial statements of UNIQA Insurance Group AG, the Management Board will therefore propose to the Annual General Meeting the payment of a dividend of €0.49 per dividend-bearing share for the 2016 financial year. Thisconstitutes a total distributionof €150 million or 102 per cent of Group profit.

In connection with the sale of the Italian companies, the related goodwill value of €115 million was impaired by €73 million. This impairment had a negative effect in2016 on the period results. However,it did not affect the operational results or the economic capital ratio (ECR ratio) – two critical parameters of dividend policy. The dividend payout for 2016, subject to the result of the Annual General Meeting, amounts to 47 per cent of the operational results. Compared to the previous year, the dividends have increased by more than 4 per cent.

Despite planned investments of around €500 million over the next ten years and the challenging economic environment, UNIQA plans to continuously increase annual dividend payments per share over the coming years as part of a progressive dividend policy.

Development of the UNIQA dividend

1) Proposal to the Annual General Meeting

In constant dialogue with analysts and investors

We attach the utmost importance to providing our shareholders as well as the entire financial community with regular, comprehensive, up-to-date information about the ongoing performance of the Company. To this end, the UNIQA management team was again available in 2016 to answer the questions of investors and analysts at numerous roadshows and banking conferences and also held a large number of one-on-one meetings during the year. The first UNIQA capital markets day took place in London on 14 March 2016. All reports and corporate information can be accessed online at: www.uniqagroup.com. In addition, our investor relations team is happy to answer individual questions: investor.relations@uniqa.at

19.5. |

Record date for the Annual General Meeting |

24.5. |

First Quarter Report 2017 |

29.5. |

Annual General Meeting |

8.6. |

Ex-dividend date |

9.6. |

Dividend record date |

12.6. |

Dividend payment date |

23.8. |

Half-year Financial Report 2017 |

16.11. |

First to Third Quarter Report 2017 |

Ticker symbol |

UQA |

Reuters |

UNIQ.VI |

Bloomberg |

UQA AV |

ISIN |

AT0000821103 |

Market segment |

Vienna Stock Exchange – prime market |

Trade segment |

Official market |

Indices |

ATX, ATX FIN, MSCI Europe Small Cap |

Number of shares |

309,000,000 |

“UNIQA is continuing on the right track.”

Andreas Wosol,Pioneer Investments

What do you see as the main questions and issues for investments in the insurance sector?

Depending on regulatory requirements, the main factors for insurance companies are the strength of the balancesheet and the ongoing ability to generate cash flow and capital. Ultimately, this affects the sustainability of the shareholder return and the capacity to distribute dividends. Depending on the business model, the crucial factor in the life insurance sector is the question of the point at which reinvestment starts to yield returns, especially in the persistent low interest environment we have been experiencing for some years now.

How do investors perceive UNIQA compared to the competition?

UNIQA’s position as market leader in the Austrian health insurance business means it offers a diversified and attractive business model. Insurance business in the CEE region also offers long-term growth potential. UNIQA has also managed to significantly reduce risk in the balance sheet. This is reflected in very stable and conservative capitalisation.

What do you think of UNIQA’s strategic focus?

As far as I can see, UNIQA has made good progress with implementing the UNIQA 2.0 strategic programme since this was launched in 2011. The current programme was redefined in 2016 and will now run until 2020; its focus on improved efficiency and earnings, as well as digitalisation means it is continuing on the right track. As I mentioned, I am particularly impressed to see a reduction in risk on the balance sheet, most recently through the sale of the Italian life insurance business. Equally positive aspects are the reorganisation of the Group and the resulting increase in efficiency and transparency.

Where do you think there might still be room for development?

The UNIQA 2.0 programme and the digital strategy have defined important strategic issues and objectives. I think there is still some potential for improvement in cost management, particularly in complexity costs. I think it would also be important to continue to reduce investments that are not part of the core business.