Premium development

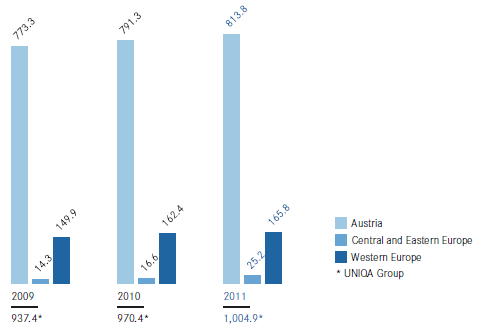

The premium volume written in the health insurance segment rose by 3.6 per cent year-on-year to € 1,004.9 million (2010: € 970.4 million), thus breaking through the one billion euro barrier for the first time. In Austria, where the UNIQA Group remains the clear leading brand in the health insurance segment, premiums of € 813.8 million were generated, up 2.8 per cent on the previous year (2010: € 791.3 million).

In Western Europe, premiums written increased by 2.1 per cent to € 165.8 million (2010: € 162.4 million). In the countries of Central and Eastern Europe, premiums in the health insurance segment grew by 51.6 per cent in 2011 to reach € 25.2 million (2010: € 16.6: million). Overall, this meant that the international share of health insurance premiums in 2011 was 19.0 per cent (2010: 18.4 per cent).

Premium volume written in health insurance

Figures in € million

In 2011, retained premiums earned in the health insurance segment (in accordance with IFRS) rose by 3.3 per cent to € 997.9 million as at the end of the year (2010: € 966.2 million).

|

Health insurance |

2011 |

2010 |

2009 |

|

Figures in € million |

|

|

|

|

Premiums written |

1,004.9 |

970.4 |

937.4 |

|

Share Central and Eastern Europe |

2.5 % |

1.7 % |

1.5 % |

|

Share Western Europe |

16.5 % |

16.7 % |

16.0 % |

|

International share |

19.0 % |

18.4 % |

17.5 % |

|

Premiums earned (net) |

997.9 |

966.2 |

933.9 |

|

Net investment income |

4.1 |

127.5 |

94.9 |

|

Insurance benefits (net) |

–853.5 |

–839.4 |

–811.8 |

|

Benefit and loss ratio (after reinsurance) |

85.5 % |

86.9 % |

86.9 % |

|

Other operating expenses less reinsurance commission |

–162.5 |

–141.4 |

–128.5 |

|

Cost ratio (after reinsurance) |

16.3 % |

14.6 % |

13.8 % |

|

Profit/loss on ordinary activities |

–16.4 |

111.9 |

85.4 |

|

Net profit/loss |

–13.5 |

82.5 |

65.3 |

|

Consolidated profit/loss |

–18.3 |

37.6 |

50.3 |

Development of insurance benefits

Retained insurance benefits increased marginally in 2011 by 1.7 per cent to € 853.5 million (2010: € 839.4 million). Because premiums earned rose to a greater extent, the benefit and loss ratio after reinsurance fell by 1.4 percentage points year-on-year to 85.5 per cent (2010: 86.9 per cent).

In Austria, insurance benefits rose by 2.3 per cent to € 697.7 million (2010: € 682.1 million). In the Western European markets, on the other hand, insurance benefits declined by 4.9 per cent to € 141.0 million (2010: € 148.2 million). In the Central and Eastern European countries, insurance benefits also increased by 62.6 per cent to € 14.8 million as a result of the sharp rise in premium revenues (2010: € 9.1 million).

Operating expenses

Total operating expenses in the health insurance segment less reinsurance commission and profit shares from reinsurance business ceded rose by 14.9 per cent to € 162.5 million in 2011 (2010: € 141.4 million). This was also attributable to the non-recurring effects in connection with the repositioning of the UNIQA Group. Acquisition costs increased by 5.9 per cent to € 94.5 million (2010: € 89.2 million), while other operating expenses rose by 30.2 per cent to € 68.0 million (2010: € 52.2 million). As a result of this development, the cost ratio in the health insurance segment increased to 16.3 per cent (2010: 14.6 per cent).

In Austria, operating expenses increased by 15.8 per cent to € 121.8 million (2010: € 105.2 million). The figure for the Western European markets rose by 8.3 per cent to € 34.2 million (2010: € 31.6 million). Operating expenses in the CEE region increased by 39.0 per cent to € 6.5 million (2010: € 4.7 million).

Investment result

In 2011, net investment income in the health insurance segment fell by 96.8 per cent to € 4.1 million (2010: 127.5 million). The investment volume in the health insurance segment remained essentially unchanged year-on-year at € 2,651.2 million (2010: € 2,648.2 million).

Profit/loss on ordinary activities, net profit/loss, consolidated profit/loss

The loss on ordinary activities in the health insurance segment amounted to minus € 16.4 million in the year under review (2010: profit of € 111.9 million). In 2011, the net loss amounted to minus € 13.5 million (2010: net profit of € 82.5 million) and the consolidated loss after taxes and minority interests amounted to minus € 18.3 million (2010: consolidated profit of € 37.6 million).