Premium development

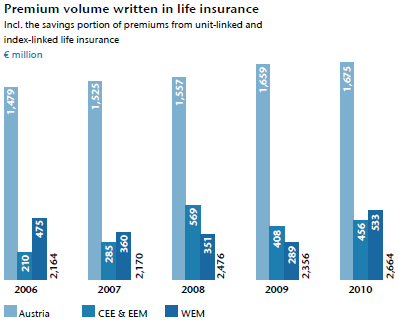

The life insurance premium volume written, including the savings portion of unit-linked and index-linked life insurance, increased drastically in 2010, up by a total of 13.1% to € 2,664 million (2009: € 2,356 million). Revenues from policies with recurring premium payments rose by 5.3% to € 1,580 million (2009: € 1,501 million). In the single premium business premiums rose even considerably more, by 26.8% to € 1,084 million (2009: € 855 million). In the classic single premium business, premiums increased by 31.3% to € 647 million (2009: € 493 million), while single premium policies in the area of unit-linked life insurance climbed by 20.8% to €437 million (2009: € 362 million).

The premium developments in Austria were very satisfactory in 2010, above all in the area of products with recurring premium payments. Revenues from policies with recurring premium payments rose by 4.3% to € 1,294 million (2009: € 1,240 million). On the other hand, single premium business declined slightly due to a reduction in classic single premiums by 8.9% to € 381 million (2009: € 418 million). All told, premium volume in Austria in life insurance thus increased by 1.0% to € 1,675 million (2009: € 1,659 million).

The life insurance business of the Group companies in the Central and Eastern European regions (CEE & EEM) also rose considerably in 2010. The premium volume written including the savings portion from the unit-linked and index-linked life insurance went up by 11.7% to € 456 million (2009: € 408 million). This brought the share of life insurance from these countries to 17.1% in 2010 (2009: 17.3%). In Western European countries, on the other hand, premium volumes grew by 84.6% to € 533 million (2009: € 289 million) due to the booming life insurance business in Italy. Overall, the Western European region (WEM) thus contributed 20.0% (2009: 12.3%) to the total life insurance premiums of the Group.

The risk premium share of unit-linked and index-linked life insurance included in the consolidated financial statements totalled €132 million in 2010 (2009: € 105 million). The savings portion of the unit-linked and index-linked life insurance lines amounted to € 845 million (2009: € 728 million) and was, in accordance with FAS 97 (US-GAAP), balanced out by the changes in the actuarial provision.

Including the savings portion of the unit-linked and index-linked life insurance (after reinsurance) in the amount of € 823 million (2009: €704 million), the premiums earned in life insurance declined by 14.0% to €2,564 million (2009: € 2,250 million). The retained premiums earned (according to IFRS) increased in 2010 by 12.6% to € 1,741 million (2009: € 1,546 million).

|

Life insurance |

2010 |

2009 |

2008 |

2007 |

2006 |

|

Premiums written |

1,819 |

1,628 |

1,653 |

1,422 |

1,605 |

|

Savings portion of premiums from unit-linked and index-linked life insurance |

845 |

728 |

823 |

748 |

559 |

|

Premiums written incl. savings portion of premiums from unit-linked and index-linked life insurance |

2,664 |

2,356 |

2,476 |

2,170 |

2,164 |

|

Share CEE & EEM |

17.1% |

17.3% |

23.0% |

13.1% |

9.7% |

|

Share WEM |

20.0% |

12.3% |

14.2% |

16.6% |

22.0% |

|

International share |

37.1% |

29.6% |

37.2% |

29.7% |

31.7% |

|

Premiums earned (net) |

1,741 |

1,546 |

1,570 |

1,342 |

1,527 |

|

Savings portion of premiums from unit-linked and index-linked life insurance (net after reinsurance) |

823 |

704 |

774 |

695 |

499 |

|

Premiums earned (net) incl. the savings portion of premiums from unit-linked and index-linked life insurance |

2,564 |

2,250 |

2,344 |

2,037 |

2,027 |

|

Net investment income |

640 |

525 |

133 |

563 |

610 |

|

Insurance benefits (net) |

–1,878 |

–1,692 |

–1,328 |

–1,534 |

–1,780 |

|

Other operating expenses less reinsurance commissions |

–384 |

–338 |

–363 |

–321 |

–261 |

|

Cost ratio (net after reinsurance) |

15.0% |

15.0% |

15.5% |

15.7% |

12.9% |

|

Profit on ordinary activities |

77 |

3 |

–27 |

5 |

56 |

|

Net profit |

59 |

–1 |

–37 |

4 |

37 |

Development of insurance benefits

The retained insurance benefits increased in the reporting period by 11.0% to € 1,878 million (2009: € 1,692 million). However, in Austria they were down by 2.4% to € 1,162 million (2009: € 1,191 million). In the Western European region (WEM), insurance benefits grew due to the strong growth in life insurance in Italy by 89.5% to € 418 million (2009: € 221 million), while they only rose moderately in Central and Eastern Europe (CEE & EEM) by 6.1% to € 298 million (2009: €281 million).

Operating expenses

Total operating expenses in life insurance less reinsurance commissions and profit shares from reinsurance business ceded rose in 2010 by 13.6% to € 384 million (2009: € 338 million). Acquisition expenses rose by 18.5% to €304 million (2009: €257 million). In contrast, other operating expenses fell by 1.7% to €80 million (2009: € 81 million). As a result of this development, the cost ratio in life insurance, i.e. the relation of all operating expenses to the Group premiums earned, including the savings portion from the unit-linked and index-linked life insurance (after reinsurance), remained stable at 15.0% (2009: 15.0%).

Investment results

Net investment income less financing costs rose in the reporting year by 21.8% to € 640 million (2009: € 525 million). The capital investments including the investments for unit-linked and index-linked life insurance grew in 2010 by 8.0% to €18,397 million (2009: € 17,028 million).

Profit on ordinary activities, net profit

The profit on ordinary activities in life insurance increased in 2010, rising by €74 million to € 77 million (2009: € 3 million). Net profit increased to €59 million (2009: € –1 million).