The weak performance of UNIQA’s shares is, of course, crucially driven by the profit for the year, which was burdened by non-recurring items. On top of that, the shares are not represented in the ATX index due to the low free float and the resulting low liquidity. It is our clear goal to increase the free float to 49 per cent and to strengthen our capital base through a re-IPO, which is scheduled for 2013, subject to attractive capital market conditions. We are already preparing for this re-IPO: we are focused on implementing the growth strategy and work agendas we decided on during the summer of 2011, we are increasing efficiency and thus the earnings power of the company, and we are creating Group structures that will be appreciated even more by the capital markets.

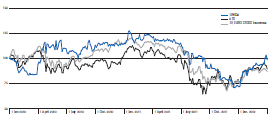

The performance of the share price in detail: having opened at € 14.70, the share had already reached its year-high of € 16.50 on 7 February. In the second quarter, we saw a sideways movement, and from July onwards the shares lost ground substantially as a result of the crisis in the Eurozone. The shares hit their low for the year on 20 December 2011 at € 9.00 and closed the year at € 9.42. In the first quarter of 2012, the shares have rebounded noticeably, rising by 35.4 per cent in the year to date to € 12.75.

|

Information on UNIQA shares |

|

|

Securities abbreviation |

UQA |

|

Reuters |

UNIQ.VI |

|

Bloomberg |

UQA.AV |

|

ISIN |

AT0000821103 |

|

Market segment |

Prime market of the Vienna Stock Exchange |

|

Trade segment |

Official trading |

|

Indices |

ATX Prime, WBI, VÖNIX |

|

Number of shares |

142,985,217 |