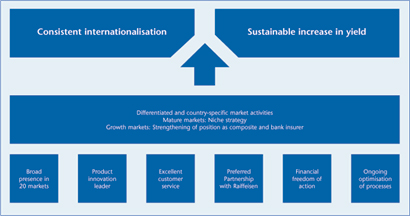

Profitable International GrowthConsistent internationalisation and a sustainable increase in

yield – these are the core goals of the UNIQA Group’s

expansion strategy. The Group continued persistently with

this strategy in 2008 despite the fact that the economic

environment on the financial markets had become considerably

more difficult by the end of the year.

The UNIQA Group continues to pursue its top-level goals – even

in the considerably harsher environment since the outbreak of

the international financial and economic crisis. Visible proof of

the success of our concerted efforts to implement our growth

strategy in 2008 was, once again, the above-average growth in

premium volume by a total of 10.4% to €5,825 million and

above all of the premium revenue in Eastern Europe by 56.7%

to €1,279 million. On the other hand, profit (before taxes) sank

to €90 million because of the economic crisis and mainly due

to the turbulences on the financial markets. Given these developments,

the UNIQA Group has also postponed its mediumterm

forecast until further notice.

Strong presence in Central, Eastern and South Eastern Europe

Targets and core strategies remain unchangedThe central strategic concern of the UNIQA Group is to preserve

its strong position in the Central and Eastern European markets

in times of tough competition and increasing globalisation. This

should make it possible for the Group to operate successfully in

the largely saturated markets in Austria and Central Europe while

at the same time actively taking advantage of the historic opportunities

presented by the exceptionally dynamic regions

encompassing 360 million people within and beyond the eastern

borders of the EU.

|

In implementing

these goals,

UNIQA is pursuing

the following

basic strategic

approaches, and

has laid them out

in operational

action plans. |

The Group defined a target for average (pre-tax) return on equity

of at least 20% as a guide to ensure successful implementation

of its strategy; up until now, the medium-term forecast for the

result was €430 million by 2010. However, in light of the volatile

market environment, as already mentioned, this has been postponed

until further notice.

As far as continuing the Group’s internationalisation is concerned,

UNIQA aims in the medium term to bring the share of international

premiums within the entire Group’s premium volume up

to 50%. Of this amount, a considerable percentage should come

from Eastern Europe. In addition, the company has set concrete

medium-term targets for the respective market shares in the

various growth markets in Central, Eastern and South Eastern

Europe.

Well-positioned in Central, Eastern andWith 40 insurance companies in a total of 20 markets, a premium revenue of €5.8 billion and investments amounting to over €21 billion, UNIQA has managed to position itself in only a few years as one of the leading market players in Central, Eastern and South Eastern Europe. In the past few years, the Group was able to expand its sphere of activities in South Eastern Europe to include Albania, Macedonia and Kosovo. At the same time, by expanding its financial commitment in Bulgaria and Ukraine, it was able to further strengthen its position in these quickly growing markets.

The most recent highlight of this expansion was in November 2008 with the 100% takeover of UNITA, the sixth-largest Romanian property insurer, giving UNIQA a market share of over 7% in one of the largest markets in the European East in one swoop. International business becoming increasingly

Premium volume 2008 by region |

|

The markets in Central, Eastern and South Eastern Europe currently

contribute 22% to the premium revenue of the UNIQA

Group; in 2008, the total portion of premiums generated by all

international business was over 38% and should be rising even

more. With this increasing internationalisation of business volume

as well as the Group results, the Group is not only diversifying

the risks of its corporate portfolio both regionally and by

product groups and distribution channels, it is also laying the

foundation for fulfilling its ambitious growth targets.

Growing share of international business |

|

In the process, the UNIQA Group is pursuing differentiated strategies in the

various regions: In Austria, UNIQA wants to maintain its strong

position with segment-focused qualitative growth and higher returns. The Western

European markets, characterised by higher insurance density, contributed

roughly 16% of the Group premiums in 2008. The Group holds profitable niches

in these markets and succeeds through exclusive offerings in individual distribution

channels such as bank and broker sales. In Central, Eastern and South

Eastern Europe, the UNIQA Group is relying not only on the optimisation

of its financial commitment but also on a targeted increase of its market shares

and on a partnership-oriented acquisition of the majority of its various associated

companies. Ongoing expansion of market presence in CEE

In order to expand its position in the new markets in a focused

manner, UNIQA launched a series of dynamisation projects in

sales. The goal is to increase the various market shares in the

non-life sector to between 5% and 7% and in the life insurance

sector to 3%. This expansion of market presence is accompanied

by a uniform brand and marketing concept throughout the

Group as well as shared policies in IT, human resources and

management training. Successful partnership with RaiffeisenIn penetrating the new insurance markets, the “Preferred Partnership”

with the Raiffeisen bank group has proved to be very

valuable. The cooperation is an efficient sales channel that now

covers 13 countries in Eastern and South Eastern Europe; all of

these areas are still highly underdeveloped, both in insurance

and banking. This means that both partners profit from the cooperation,

which also promises to continue bringing aboveaverage

growth levels in the future. Since 2004, the first year of

this cooperation, the premium volume generated together has

increased to over €380 million in the year 2008.

|

The “Preferred Partnership” with Raiffeisen

International has proven to be very valuable in a

number of markets in Eastern and South Eastern Europe. |

Innovative leadership ensures a competitive

“International growth and a

sustainable increase in yields

made possible by excellent

performance, innovative leadership

and ongoing optimisation;

these are our central

goals – yesterday, today

and tomorrow.”

Konstantin Klien, Chairman of the Management Board |

As it expands, the UNIQA Group will continue to persistently

leverage its strengths as a product pioneer and innovation

leader. The company will continue its approach of laying claim

to certain topics of the future, thereby confirming its reputation

as a trendsetter over the long term.

UNIQA can look back on a long tradition of innovative product

design, giving it an obvious competitive advantage on the market.

Recent examples of this are the first kilometre-dependent

motor vehicle insurance with additional safety features and a

highly innovative product for long-term old-age pensions, which

blends elements of classic and unit-linked life insurance with a completely new level of flexibility so that it can be adapted at

any time to the current needs of the customer. As market leader

in health insurance, UNIQA set new standards by combining

extensive medical insurance protection with effective preventive

measures and useful assistance services. Innovative services for

premium category customers, customised offers for children

and packages for expatriates round off the portfolio. Promoting customer loyalty with differentiated

Innovative products are supplemented by a broad range of service instruments

that create an attractive added value for customers, binding them more strongly

to the company. In this way, UNIQA proves its high level of expertise in developing

products with additional value and unique selling points in the market. This

reinforces the brand’s image and aids both the acquisition of new customers

and targeted cross-selling in the sense of a “total customer” strategy. Offers

such as the extensive information service UNIQA Companion,

the UNIQA QualityPartnership and the extremely popular weather

warnings by SMS and e-mail have all been very well received.

As an additional success factor, UNIQA cultivates the capability

of its employees to find innovative solutions by providing ongoing

training as part of its customised staff development

programmes. The outstanding quality of the Group’s human

capital on all levels is essential for the successful implementation

of its corporate strategy, which is why it is constantly refined

and developed through aggressive personnel management. This

includes flexibility and mobility across country borders. EBRD expands financial optionsAn important factor in UNIQA’s expansion in Eastern Europe is

provided by the European Bank for Reconstruction and Development

(EBRD). In 2007, the EBRD increased the scope of its

financial cooperation with the Group from the previous €70

million to the current €150 million. This provides UNIQA with

noticeably more funds for minority investments by the EBRD in

UNIQA companies in Central and Eastern Europe. Consistent process optimisation

Further potential for sustainable expansion has been created

with UNIQA’s third Profit Improvement Programme 2007–2010.

It should bring a clear improvement in the profit on ordinary

activities by 2010. To this end, UNIQA has developed concrete

action plans, making an effort to noticeably lower the claim and

cost ratios even further, to compress structures, eliminate redundant

work in the corporation and save money by outsourcing

certain tasks to international Group companies. The Management Board of UNIQA Versicherungen AG

Hannes Bogner, Andreas Brandstetter, Konstantin Klien, Karl Unger, Gottfried

Wanitschek (from left to right)

Hannes Bogner, Andreas Brandstetter, Konstantin Klien, Karl Unger, Gottfried

Wanitschek (from left to right)

|

Hannes Bogner

Member of the

Management Board

- Born in 1959

- Academic background:

Business administration

Hannes Bogner has been

with the UNIQA Group

since 1994 and was appointed

to the Management

Board in 1998. Prior

to this, he worked at THS

Treuhand Wirtschaftsprüfungsgesellschaft

in

Salzburg and at PwC

PricewaterhouseCoopers in

Vienna. Mr. Bogner became

a tax consultant in 1988

and a chartered accountant

in 1993.

Responsible for:

Group

accounting, planning

and controlling, asset

management (back office),

investor relations,

industry customers and

reinsurance policy

Country responsibility:

Germany, Italy, Poland,

Switzerland

Andreas Brandstetter

Member of the

Management Board

- Born in 1969

- Academic background:

Political science and

history

Dr. Brandstetter joined

the Group in 1997 and

was responsible for the

restructuring of UNIQA

Versicherungen AG in

1999; he was appointed

to the Management Board

in 2002. Before that, he

was head of the EU office

of the Austrian Raiffeisenverband

in Brussels and

completed the MBA programme

at the California

State University.

Responsible for:

New

markets, mergers &

acquisitions, bank sales

policy

Country responsibility:

Albania, Bulgaria,

Kosovo, Macedonia,

Montenegro, Romania,

Russia, Serbia, Slovenia,

Ukraine

Konstantin Klien

Chairman of the

Management Board

- Born in 1951

- Academic background:

Economics

Dr. Klien joined the UNIQA

Group in October 2000

as Vice Chairman of the

Management Board.

Since 1 January 2002,

he has been Chairman of

the Management Board

and CEO of UNIQA

Versicherungen AG.

Dr. Klien began his professional

career at Arthur

Andersen and transferred

to Nordstern Versicherung

in 1978, where he was

appointed to the

Management Board in

1986. In 1991, he became

Chairman of the Board of

the holding company AXA

Austria and also exercises

executive functions for the

AXA companies in Central

Europe since 1995.

Responsible for:

Group

management, sales,

planning and controlling,

human resources,

marketing, communications,

investor relations,

internal auditing

Country responsibility:

Austria

Karl Unger

Member of the

Management Board

- Born in 1953

- Academic background:

Actuarial mathematics

Karl Unger began his professional

career in 1979 as

an actuary at Volksfürsorge

Versicherung. He later

transferred to Nordstern

Versicherung, where he was

appointed to the Management

Board in 1994 and

took over the life insurance

department. In 1999, Karl

Unger took on responsibility

for Central Europe within

the AXA Group. He switched

to UNIQA in 2001 as head

of the administrative department

for corporate

planning and joined the

Management Board of

UNIQA Versicherungen AG

in 2002.

Responsible for:

Private

customer business, IT,

company organisation,

customer service, Group

actuarial office, risk

management

Country responsibility:

Liechtenstein, Hungary,

Slovakia

Gottfried Wanitschek

Member of the

Management Board

- Born in 1955

- Academic background:

Law

Dr. Wanitschek started working in the insurance business back in the eighties

and was first head of the legal office and later secretary general of Raiffeisen

Versicherung AG. From 1991 until he was appointed to the Management Board of

UNIQA Versicherungen AG in 1997, he was director of Beteiligungsholding Leipnik-Lundenburger

Industrie AG, managing director of Kurier GmbH, member of the executive management

at Mediaprint and director of Zeitschriften-Verlagsbeteiligungs-AG.

Responsible for:

Asset

management (front

office), equity holdings,

property management,

legal affairs, general

administration, internal

auditing

Country responsibility:

Bosnia and Herzegovina,

Croatia, Czech Republic

|

Group 2008

Group 2008 Strategy

Strategy

Contact

Contact