|

|

|

|  |  |  |  |

| Path: Home Group 2008 Group 2008 Strategy Strategy |

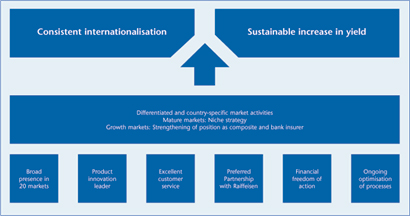

| | StrategyProfitable International GrowthConsistent internationalisation and a sustainable increase in

yield – these are the core goals of the UNIQA Group’s

expansion strategy. The Group continued persistently with

this strategy in 2008 despite the fact that the economic

environment on the financial markets had become considerably

more difficult by the end of the year.

The UNIQA Group continues to pursue its top-level goals – even

in the considerably harsher environment since the outbreak of

the international financial and economic crisis. Visible proof of

the success of our concerted efforts to implement our growth

strategy in 2008 was, once again, the above-average growth in

premium volume by a total of 10.4% to €5,825 million and

above all of the premium revenue in Eastern Europe by 56.7%

to €1,279 million. On the other hand, profit (before taxes) sank

to €90 million because of the economic crisis and mainly due

to the turbulences on the financial markets. Given these developments,

the UNIQA Group has also postponed its mediumterm

forecast until further notice.

Strong presence in Central, Eastern and South Eastern Europe

Targets and core strategies remain unchangedThe central strategic concern of the UNIQA Group is to preserve

its strong position in the Central and Eastern European markets

in times of tough competition and increasing globalisation. This

should make it possible for the Group to operate successfully in

the largely saturated markets in Austria and Central Europe while

at the same time actively taking advantage of the historic opportunities

presented by the exceptionally dynamic regions

encompassing 360 million people within and beyond the eastern

borders of the EU.

|

In implementing

these goals,

UNIQA is pursuing

the following

basic strategic

approaches, and

has laid them out

in operational

action plans. |

The Group defined a target for average (pre-tax) return on equity

of at least 20% as a guide to ensure successful implementation

of its strategy; up until now, the medium-term forecast for the

result was €430 million by 2010. However, in light of the volatile

market environment, as already mentioned, this has been postponed

until further notice.

As far as continuing the Group’s internationalisation is concerned,

UNIQA aims in the medium term to bring the share of international

premiums within the entire Group’s premium volume up

to 50%. Of this amount, a considerable percentage should come

from Eastern Europe. In addition, the company has set concrete

medium-term targets for the respective market shares in the

various growth markets in Central, Eastern and South Eastern

Europe.

Well-positioned in Central, Eastern andWith 40 insurance companies in a total of 20 markets, a premium revenue of €5.8 billion and investments amounting to over €21 billion, UNIQA has managed to position itself in only a few years as one of the leading market players in Central, Eastern and South Eastern Europe. In the past few years, the Group was able to expand its sphere of activities in South Eastern Europe to include Albania, Macedonia and Kosovo. At the same time, by expanding its financial commitment in Bulgaria and Ukraine, it was able to further strengthen its position in these quickly growing markets.

The most recent highlight of this expansion was in November 2008 with the 100% takeover of UNITA, the sixth-largest Romanian property insurer, giving UNIQA a market share of over 7% in one of the largest markets in the European East in one swoop. International business becoming increasingly

Premium volume 2008 by region |

|

The markets in Central, Eastern and South Eastern Europe currently

contribute 22% to the premium revenue of the UNIQA

Group; in 2008, the total portion of premiums generated by all

international business was over 38% and should be rising even

more. With this increasing internationalisation of business volume

as well as the Group results, the Group is not only diversifying

the risks of its corporate portfolio both regionally and by

product groups and distribution channels, it is also laying the

foundation for fulfilling its ambitious growth targets.

Growing share of international business |

|

In the process, the UNIQA Group is pursuing differentiated strategies in the

various regions: In Austria, UNIQA wants to maintain its strong

position with segment-focused qualitative growth and higher returns. The Western

European markets, characterised by higher insurance density, contributed

roughly 16% of the Group premiums in 2008. The Group holds profitable niches

in these markets and succeeds through exclusive offerings in individual distribution

channels such as bank and broker sales. In Central, Eastern and South

Eastern Europe, the UNIQA Group is relying not only on the optimisation

of its financial commitment but also on a targeted increase of its market shares

and on a partnership-oriented acquisition of the majority of its various associated

companies. Ongoing expansion of market presence in CEE

In order to expand its position in the new markets in a focused

manner, UNIQA launched a series of dynamisation projects in

sales. The goal is to increase the various market shares in the

non-life sector to between 5% and 7% and in the life insurance

sector to 3%. This expansion of market presence is accompanied

by a uniform brand and marketing concept throughout the

Group as well as shared policies in IT, human resources and

management training. Successful partnership with RaiffeisenIn penetrating the new insurance markets, the “Preferred Partnership”

with the Raiffeisen bank group has proved to be very

valuable. The cooperation is an efficient sales channel that now

covers 13 countries in Eastern and South Eastern Europe; all of

these areas are still highly underdeveloped, both in insurance

and banking. This means that both partners profit from the cooperation,

which also promises to continue bringing aboveaverage

growth levels in the future. Since 2004, the first year of

this cooperation, the premium volume generated together has

increased to over €380 million in the year 2008.

|

The “Preferred Partnership” with Raiffeisen

International has proven to be very valuable in a

number of markets in Eastern and South Eastern Europe. |

|

| | |

|

| © 2008 by UNIQA Versicherungen AG | | | |

Group 2008

Group 2008 Strategy

Strategy

Contact

Contact