|

in € million |

2014 |

2013 |

Change |

||||||||

|

|||||||||||

|

Premiums written |

5,519.7 |

5,157.6 |

+7.0% |

||||||||

|

Savings portions from unit-linked and index-linked life insurance (before reinsurance) |

544.7 |

727.9 |

–25.2% |

||||||||

|

Premiums written including savings portions from unit-linked and index-linked life insurance |

6,064.4 |

5,885.5 |

+3.0% |

||||||||

|

of which property and casualty insurance |

2,620.9 |

2,590.5 |

+1.2% |

||||||||

|

of which health insurance |

960.8 |

937.6 |

+2.5% |

||||||||

|

of which life insurance |

2,482.7 |

2,357.4 |

+5.3% |

||||||||

|

of which income from regular premiums |

1,521.0 |

1,674.6 |

–9.2% |

||||||||

|

of which single premiums |

961.6 |

682.8 |

+40.8% |

||||||||

|

Premiums written including savings portions from unit-linked and index-linked life insurance |

6,064.4 |

5,885.5 |

+3.0% |

||||||||

|

of which UNIQA Österreich |

2,773.5 |

2,806.7 |

–1.2% |

||||||||

|

of which Raiffeisen Insurance |

905.3 |

878.5 |

+3.1% |

||||||||

|

of which UNIQA International AG |

2,353.1 |

2,162.4 |

+8.8% |

||||||||

|

of which reinsurance |

1,189.3 |

1,633.1 |

–27.2% |

||||||||

|

of which of which Group functions and consolidation |

–1,156.9 |

–1,595.1 |

–27.5% |

||||||||

|

|

|

|

|

||||||||

|

Premiums earned (net)1) |

5,312.9 |

4,938.6 |

+7.6% |

||||||||

|

of which property and casualty insurance |

2,482.9 |

2,441.5 |

+1.7% |

||||||||

|

of which health insurance |

960.0 |

936.2 |

+2.5% |

||||||||

|

of which life insurance |

1,870.0 |

1,560.9 |

+19.8% |

||||||||

|

Savings portions from unit-linked and index-linked life insurance (after reinsurance) |

526.1 |

702.3 |

–25.1% |

||||||||

|

Premiums earned including savings portions from unit-linked and index-linked life insurance |

5,839.0 |

5,640.9 |

+3.5% |

||||||||

|

|

|

|

|

||||||||

|

–4,383.7 |

–3,959.4 |

+10.7% |

|||||||||

|

of which property and casualty insurance |

–1,723.6 |

–1,633.8 |

+5.5% |

||||||||

|

of which health insurance |

–780.5 |

–768.7 |

+1.5% |

||||||||

|

of which life insurance |

–1,879.6 |

–1,556.9 |

+20.7% |

||||||||

|

|

|

|

|

||||||||

|

Operating expenses (net)2) |

–1,275.3 |

–1,354.2 |

–5.8% |

||||||||

|

of which property and casualty insurance |

–746.1 |

–803.2 |

–7.1% |

||||||||

|

of which health insurance |

–163.4 |

–162.1 |

+0.8% |

||||||||

|

of which life insurance |

–365.9 |

–388.9 |

–5.9% |

||||||||

|

Cost ratio (after reinsurance) |

21.8% |

24.0% |

– |

||||||||

|

|

|

|

|

||||||||

|

Combined ratio (after reinsurance) |

99.5% |

99.8% |

– |

||||||||

|

|

|

|

|

||||||||

|

Net investment income |

864.4 |

780.0 |

+10.8% |

||||||||

|

|

|

|

|

||||||||

|

Profit/(loss) from ordinary activities |

377.9 |

307.6 |

+22.9% |

||||||||

|

Profit/(loss) for the year |

292.9 |

287.9 |

+1.7% |

||||||||

|

Consolidated profit/(loss) |

289.9 |

284.7 |

+1.8% |

||||||||

|

|

|

|

|

||||||||

|

Return on equity (ROE) after taxes and non-controlling interests |

9.9% |

11.9% |

– |

||||||||

|

|

|

|

|

||||||||

|

Investments3) |

29,212.7 |

27,383.6 |

+6.7% |

||||||||

|

Equity |

3,082.2 |

2,763.1 |

+11.5% |

||||||||

|

Total equity including non-controlling interests |

3,102.4 |

2,785.1 |

+11.4% |

||||||||

|

Technical provisions (net)4) |

25,629.6 |

24,208.8 |

+5.9% |

||||||||

|

Total assets |

33,038.2 |

31,001.7 |

+6.6% |

||||||||

|

|

|

|

|

||||||||

|

Number of insurance contracts |

19,214,570 |

18,556,615 |

+3.5% |

||||||||

|

Average number of employees |

14,336 |

14,277 |

+0.4% |

||||||||

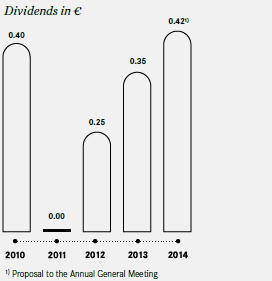

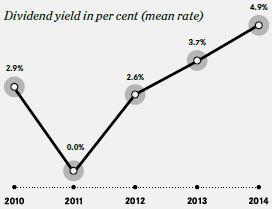

History of UNIQA dividends

|

|

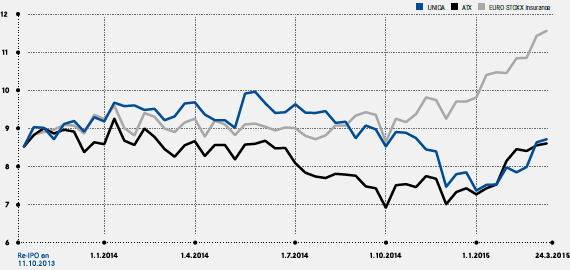

UNIQA share performance

UNIQA shares – key figures

|

in € |

2014 |

2013 |

2012 |

2011 |

2010 |

||

|

|||||||

|

UNIQA share price as at 31 December |

7.78 |

9.28 |

9.86 |

9.42 |

14.70 |

||

|

High |

10.02 |

11.14 |

13.40 |

16.50 |

15.34 |

||

|

Low |

7.34 |

8.12 |

8.75 |

9.00 |

10.68 |

||

|

Average turnover/day (in € million) |

3.2 |

1.5 |

0.1 |

0.1 |

0.5 |

||

|

Market capitalisation as at 31/12 (in € million) |

2,404.0 |

2,867.5 |

2,112.5 |

1,346.9 |

2,102.0 |

||

|

0.94 |

1.21 |

0.75 |

–1.73 |

0.30 |

|||

|

Dividend per share |

0.421) |

0.35 |

0.25 |

0 |

0.40 |

||