With € 5,739 million in premiums written, including the savings portion of unit- and index-linked life insurance, UNIQA is one of the leading insurance groups in Central and Eastern Europe. The savings portion of premiums from unit-linked and index-linked life insurance amounting to € 728 million is, in accordance with FAS 97 (US-GAAP), balanced out by the changes in the actuarial provision. Premium volume excluding the savings portion from the unit- and index-linked life insurance amounts to € 5,012 million.

UNIQA in Europe

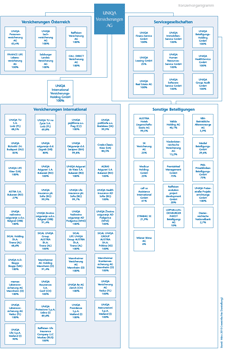

The UNIQA Group offers its products and services through all distribution channels (salaried sales force, general agencies, brokers, banks and direct sales). UNIQA is active in all types of insurance and operates its direct insurance business in Austria through UNIQA Personenversicherung AG, UNIQA Sachversicherung AG, Raiffeisen Versicherung AG, FINANCE LIFE Lebensversicherung AG, Salzburger Landes-Versicherung AG and CALL DIRECT Versicherung AG.

The listed Group holding company, UNIQA Versicherungen AG, is responsible for Group management, operates the indirect insurance business and is the central reinsurer for the Group's Austrian operational companies. In addition, it carries out numerous service functions for the Austrian and international insurance subsidiaries in order to take best advantage of synergy effects within all the Group companies and to consistently implement the Group’s long-term corporate strategy. UNIQA Re AG has its headquarters in Zürich and is responsible for reinsuring the Group’s international operational companies. In order to achieve maximum synergy effects, the international activities of the UNIQA Group are managed centrally through Competence Centers as well as the Group’s Central Services, and UNIQA International Versicherungs-Holding GmbH is responsible for ongoing monitoring and analysis of the international target markets for acquisitions as well as for integration of acquisitions into the Group.

UNIQA offers life insurance in Russia

The UNIQA Group expanded its strategic target area to include Russia in 2009 through the founding of a new subsidiary. Raiffeisen Life Versicherung worked with ZAO Raiffeisenbank to develop special life insurance products for the Russian market that are now offered through the partner’s roughly 200 bank branches. UNIQA and Raiffeisen cooperate very successfully in Austria and now in 14 Eastern and South-Eastern European countries as “Preferred Partners” in product development, product portfolio, customer support and in the sale of insurance through banks. The wealth of experience from this cooperation now benefits bank and insurance companies in Russia as well.

UNIQA deepens cooperation with Veneto Banca

At the end of June 2009, the UNIQA Group extended and deepened its cooperation with the Italian Veneto Banca Group in the sale of insurance polices through the bank’s branch offices. In connection with this, UNIQA Previdenza took over 90% of the share capital of UNIQA Life S.p.A., registered in Milan. The new rights for sales cooperation by Veneto Banca with life insurance companies are now exclusively linked to this company. UNIQA Previdenza will continue to maintain the traditional sales channels for life insurance as well as manage the other bank sales while the new subsidiary will focus on sales via Veneto Banca.

Companies included in the IFRS consolidated financial statements

Along with UNIQA Versicherung AG, the 2009 consolidated financial statements of the UNIQA Group include 48 domestic and 84 foreign companies. A total of 34 affiliated companies whose influence on an accurate presentation of the actual financial status of the assets, financial position and profitability was insignificant were not included in the consolidated financial statements. In addition, we included ten domestic and one foreign company as associates according to the equity accounting method. Fourteen associates were of minor importance, and shares held in these companies are recognised at market value.

The scope of fully consolidated companies was expanded as of 1 April 2009 to include PremiaMed Management GmbH (formerly Humanomed Krankenhaus Management Gesellschaft m.b.H.) and the sub-group of PKB Privatkliniken Beteiligungs GmbH. The two companies were previously reported within the UNIQA scope of consolidation as associated companies (“at equity”). Raiffeisen Life Insurance Company LLC in Moscow, which was founded in the first quarter of 2009, began its active business operations and was fully consolidated in the third quarter of 2009. The sub-group of SIGAL Holding Sh.A. in Albania, Kosovo and Macedonia and UNIQA Life S.p.A. in Italy were fully consolidated for the first time as of 31 December 2009. SIGAL Holding Sh.A. was previously reported as an associated company (“at equity”).

Details on the consolidated and associated companies are contained in the corresponding overview in the Group notes. The accounting and valuation methods used as well as the changes in the scope of consolidation are also explained in the Group notes.

Risk report

The comprehensive risk report of the UNIQA Group is in the notes to the consolidated financial statements 2009.

UNIQA Group business development

The following comments to the business development are divided into two sections. The section “Group business development” describes the business performance from the perspective of the Group with fully consolidated amounts. Fully consolidated amounts are also used in the Group management report for reporting on the development of the business segments of “property and casualty insurance”, “health insurance” and “life insurance”.