Premium development

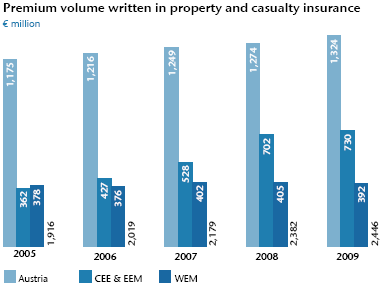

In property and casualty insurance, the UNIQA Group was able to continue the positive developments of the previous year again in 2009, increasing the premiums written by 2.7% to € 2,446 million (2008: € 2,382 million). The premium volume in Austria grew significantly better than the market average at 3.9% to reach € 1,324 million (2008: € 1,274 million). In the Central and Eastern European regions (CEE & EEM), the growth continued in 2009 even despite the negative currency effects. The premiums written grew by 4.1% to € 730 million (2008: € 702 million), thereby contributing 29.9% (2008: 29.5%) to the Group premiums in property and casualty insurance. In the Western European Markets, on the other hand, the premium volume fell in 2009: the premiums written were taken back by 3.3% to € 392 million (2008: € 405 million). Overall, the international share of Group premiums in this segment amounted to 45.9% (2008: 46.5%).

Details on premium volume written in the most important risk classes can be found in the Group notes (no. 31).

The retained premiums earned (according to IFRS) in property and casualty insurance totalled € 2,290 million in the reporting year (2008: € 2,214 million) after growth of 3.4%.

| (XLS:) Download Excel |

|

Property and casualty |

2009 |

2008 |

2007 |

2006 |

2005 |

|

Premiums written |

2,446 |

2,382 |

2,179 |

2,019 |

1,916 |

|

Share CEE & EEM |

29.9% |

29.5% |

24.2% |

21.1% |

18.9% |

|

Share WEM |

16.0% |

17.0% |

18.5% |

18.6% |

19.8% |

|

International share |

45.9% |

46.5% |

42.7% |

39.7% |

38.7% |

|

Premiums earned (net) |

2,290 |

2,214 |

1,858 |

1,716 |

1,628 |

|

Net investment income |

97 |

42 |

258 |

141 |

131 |

|

Insurance benefits (net) |

–1,552 |

–1,412 |

–1,251 |

–1,130 |

–1,106 |

|

Net loss ratio (after reinsurance) |

67.8% |

63.8% |

67.3% |

65.9% |

68.0% |

|

Gross loss ratio (before reinsurance) |

69.7% |

62.4% |

68.1% |

63.9% |

66.4% |

|

Other operating expenses less reinsurance commissions |

–800 |

–740 |

–606 |

–569 |

–553 |

|

Cost ratio (net after reinsurance) |

34.9% |

33.4% |

32.6% |

33.2% |

34.0% |

|

Net combined ratio (after reinsurance) |

102.7% |

97.2% |

99.9% |

99.0% |

101.9% |

|

Gross combined ratio (before reinsurance) |

103.0% |

94.4% |

99.0% |

95.4% |

98.4% |

|

Profit on ordinary activities |

–5 |

113 |

238 |

129 |

81 |

|

Net profit |

–20 |

104 |

193 |

104 |

54 |

Developments in insurance benefits

The total retained insurance benefits increased in 2009 by 9.9% to € 1,552 million (2008: € 1,412 million), weighed down by major claims and, in particular, the storms in the third quarter (gross encumbrance of roughly € 110 million; after reinsurance about € 48 million). In Austria, the insurance benefits increased by 19.7% to € 968 million (2008: € 808 million); in Western Europe (incl. Austria), however, the increase was less pronounced at 7.0% to reach € 1,130 million (2008: € 1,056 million). In the Central and Eastern European regions (CEE & EEM), the insurance benefits increased by 18.6% to € 422 million (2008: € 356 million).

As a result of this development, the net loss ratio (retained insurance benefits relative to premiums earned) rose by 4.0 percentage points to 67.8% (2008: 63.8%). The gross loss ratio (before reinsurance) at the end of 2009 was 69.7% (2008: 62.4%). In Austria, the net loss ratio in the past financial year rose to 74.3% (2008: 65.3%) due to the storms.

Operating expenses, combined ratio

Total operating expenses in property and casualty insurance less reinsurance commissions and profit shares from reinsurance business ceded rose by 8.0% to € 800 million (2008: € 740 million). In the process, acquisition costs rose by 5.1% to € 519 million (2008: € 493 million), other operating expenses increased by 13.8% to € 281 million (2008: € 247 million) due to increased social capital expenditures.

The cost ratio in property and casualty insurance increased in the past financial year to 34.9% (2008: 33.4%) as a result of this development. The net combined ratio increased due to the rise in the loss ratio and was at 102.7% in 2009 (2008: 97.2%). Excluding the claims from the storms in the third quarter, the combined ratio was 100.7%. The combined ratio before reinsurance was 103.0% (2008: 94.4%).

Investment results

Net investment income less financing costs rose in the past year by 129.1% to € 97 million (2008: € 42 million). The capital investments in property and casualty insurance declined by 3.8% to € 3,189 million (2008: € 3,315 million).

Profit on ordinary activities, net profit

The profit on ordinary activities in property and casualty insurance in 2009 was negative due to the exceptional impacts of the third quarter storms and an accumulation of major loses and amounted to € –5 million (2008: € 113 million). Net profit fell to € –20 million (2008: € 104 million).