Premium development

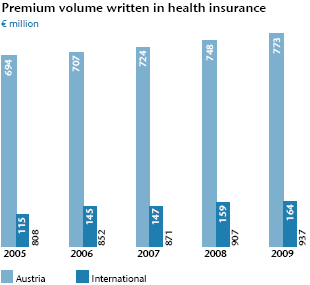

In comparison to the previous year, premiums written in health insurance increased by 3.3% to € 937 million (2008: € 907 million). In Austria, where UNIQA claimed market leadership in health insurance again in 2009, the premium volume in grew over the previous year by 3.4% to reach € 773 million (2008: € 748 million). In the WEM region, premiums written remained at the level of the previous year at € 150 million (2008: € 151 million). In the countries of Eastern and South Eastern Europe, the premiums in health insurance grew by 68.3% to already reach € 14 million (2008: € 8 million). Overall, the international share in the total health insurance premiums in 2009 was 17.5% (2008: 17.6%).

In 2009, the retained premiums earned in health insurance (according to IFRS) rose by 3.1% to reach € 934 million at the end of the year (2008: € 906 million).

| (XLS:) Download Excel |

|

Health |

2009 |

2008 |

2007 |

2006 |

2005 |

|

Premiums written |

937 |

907 |

871 |

852 |

808 |

|

International share |

17.5% |

17.6% |

16.9% |

17.0% |

14.2% |

|

Premiums earned (net) |

934 |

906 |

869 |

849 |

812 |

|

Net investment income |

94 |

14 |

134 |

114 |

101 |

|

Insurance benefits (net) |

–812 |

–783 |

–776 |

–772 |

–739 |

|

Other operating expenses less reinsurance commissions |

–129 |

–133 |

–128 |

–135 |

–130 |

|

Cost ratio (net after reinsurance) |

13.8% |

14.7% |

14.7% |

15.9% |

16.0% |

|

Profit on ordinary activities |

85 |

3 |

96 |

54 |

41 |

|

Net profit |

65 |

–1 |

72 |

35 |

35 |

Developments in insurance benefits

The retained insurance benefits increased in 2009 by 3.7% to € 812 million (2008: € 783 million). The loss ratio after reinsurance rose slightly to 86.9% (2008: 86.4%). In Austria, insurance benefits grew by 4.0% to € 667 million (2008: € 641 million). The insurance benefits in the international markets increased by just 2.2% in 2009, totalling € 145 million (2008: € 142 million).

Operating expenses

Total operating expenses in health insurance less reinsurance commissions and profit shares from reinsurance business ceded fell in 2009 in by 3.2% to € 129 million (2008: € 133 million). Acquisition expenses declined by 8.9% to € 79 million (2008: € 87 million) despite the increased premium volume. Other operating expenses grew by 7.3% to € 50 million (2008: € 46 million). As a result of this development, the cost ratio in health insurance decreased further in 2008 to 13.8% (2008: 14.7%).

Investment results

The net investment income less financing costs rose in 2009 by € 80 million to € 94 million (2008: € 14 million). In the health insurance segment, capital investments grew by 5.9% to € 2,424 million (2008: € 2,288 million).

Profit on ordinary activities, net profit

Due to good capital market developments, the profit on ordinary activities in health insurance rose steeply in the reporting year by € 82 million to € 85 million (2008: € 3 million). Net profit increased in 2009 to € 65 million (2008: € –1 million).