|

|

|

|  |  |  |  |

| Path: Home Image Report Image Report Processes & Products Processes & Products |

| | Processes & ProductsVersatility in Satisfying the Highest StandardsConsistent product innovation and flexible responses to the

specific needs of its customers are among the UNIQA Group’s

central success factors. Creative product design is just as

important here as modern information technology. Advantage through innovationUNIQA regularly introduces new products to the market, proving

itself again and again to be a leader in innovation in the

Austrian insurance business. Be it property, health, casualty or

life insurance – UNIQA puts the spotlight on customised solutions

and excellent benefits for the customer. Other initiatives for safety and the environmentSince July 2008, as part of the Raiffeisen Climate Protection

Initiative, UNIQA and Raiffeisen Versicherung have been

supporting

private customers who build their homes in accordance

with environmental guidelines, in particular when they use

energy-saving construction methods. These customers receive

an energy bonus in the shape of a premium exemption: they

pay no premiums for the first two insurance months. In addition,

UNIQA can help you find energy advisers who are authorised

to draw up the building’s Energy Performance Certificate which

has been required since 2008.

UNIQA’s campaign Auto & Netz helps protect the environment

in a different way. It rewards automobile drivers who also own

an annual public transportation ticket by dropping the first two

months’ premiums of their motor vehicle insurance.

UNIQA carried out a special initiative in property insurance in

2008 for the European Football Championships, which were

played in part in Austria. More than 200,000 customers were

insured against vandalism during the Championship as part of

UNIQA’s programme for regular customers without having to

pay any additional premiums. Market leadership reinforced with MedUNIQA

MedUNIQA Card – Valuable service for

special class customers |

UNIQA was able to highlight its position as Austria’s market

leader in health insurance with attractive new offers, providing

a comprehensive product portfolio once again in 2008. The

most important highlight here was the introduction of the new

MedUNIQA card, now including additional special information

and services for UNIQA’s special class customers.

|

- “Entrance ticket” for special class customers

- Membership card for the UNIQA VitalClub

- Access to the UNIQA Medikamentenkompass

- Access to the Spitalskompass

- Can be upgraded to contain medical results

|

Approximately

500,000 special class insured customers received a new card

that can be used as before as an “entrance ticket” to special

class services and also still serves as a membership card to the

UNIQA VitalClub.

But the new card can do much more: it offers access to the

UNIQA Medikamentenkompass, an online database that lists

any negative interactions between various medicines. Customers

can also take a look at the Spitalskompass; this can be a

valuable tool for patients when it comes to making a decision

about which hospital to go to. It also contains information, for

example, about which treatments are carried out at which

hospitals.

Focus on processing qualityOffering optimal and quick service that is easy for the customer

is one of UNIQA Group’s top priorities and constitutes an important

competitive edge. Whether it’s the speed with which

the policies are issued, processing of inquiries and claims or

providing information to customers, all services are enhanced

by cutting-edge information technology and customer-friendly

design.

myUNIQA.at – The practical online customer platform

In the service of the customer |

With the myUNIQA.at portal, UNIQA has created a universal

online tool and an optimal platform for its customers similar to

the online banking platform common in the banking sector. All

information can be called up through this portal – from a detailed

overview of the policies, the latest payment plans and the responsible

customer representative to the number of points customer have

in the PartnerPunkte programme in the QUALITYPARTNERSHIP.

The confirmations of premium payments needed for the Ministry

of Finance can be obtained online through myUNIQA.at

and the portal is also the right place to go with complaints and

suggestions. As part of the myUNIQA portal, the customer also

receives a regular e-newsletter with the latest information about

products and campaigns. The only prerequisite for participating

is a valid policy with UNIQA. The customer can call up all his

password-protected information at any time comfortably from

his home in real time, and decide how to make his arrangements.

Already 40,000 customers are using this attractive and

easy offer.

|

- Total transparency and information at myUNIQA.at

- Record time for issuing policies starting from 48 hours

- The customer information system called U.KIS provides

optimal support for working the market

|

|

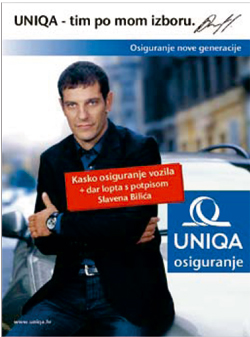

First class products and services – in new markets as well as in Austria. In Croatia, UNIQA has been

marketing with Slaven Bilič since autumn of 2008; as trainer of the national football team, he enjoys

the status of a national hero. The sponsoring contract was concluded for two years. |

Issuing policies in record timeWhen the direct electronic transfer of applications from the Raiffeisen

banks to Raiffeisen Versicherung was enabled in 2005, it

clearly sped up the time it took to issue new insurance policies.

In ideal situations the policy can be printed overnight and sent

to the customer within a record 48 hours. This has considerably

increased the level of service of the Raiffeisen banks as a sales

partner. UNIQA’s customer information system enables optimal customer support and market communication

“In addition to consistent

product innovation, flexibility

and speed are decisive

for survival and success in

the market. UNIQA is one

of the leading players in

all of these points.”

Karl Unger, Member of the Management Board |

By implementing the UNIQA customer information system

(U.KIS) back in 2006, the UNIQA Group took a decisive step

towards optimally tapping into and managing customer potential.

This online database keeps track of the customer relationship

in its entirety – completely detached from the individual

insurance segments. The second phase of this system already

went into operation in the middle of 2007. Since then, a customer

compass and a scheduling system have been added to

the U.KIS and it now integrates online rate fixing for the most

common insurance products. In 2008, the system was expanded

to include the direct issuance of policies and analysis tools to

support sales campaigns. In 2009, the focus will be on training

the users and increasing user-friendliness.

The electronic access to the individual profiles of each policyholder

offers the opportunity for service tailored to individual

needs. In this manner, the system allows for improved service

quality, thus encouraging customer loyalty. At the same time,

by seeing the entire portfolio of each individual customer relationship

all at once, UNIQA can quickly pass the advantages

of more risk-appropriate and customised premiums on to its

customers because all available customer information can be

considered when determining the premiums.

In addition, the system highlights the potentials for cross-selling,

enabling high-yield customers to be targeted directly. Particularly

in times of crisis, UNIQA can then address them with even

more attractive terms. Thus, U.KIS has proved to be a valuable

instrument of sales and customer policies. It ensures the Group

will have a decisive advantage in cultivating the market and that

customers will receive service tailored to their needs. |

| | |

|

| © 2008 by UNIQA Versicherungen AG | | | |

Image Report

Image Report Processes & Products

Processes & Products

Contact

Contact