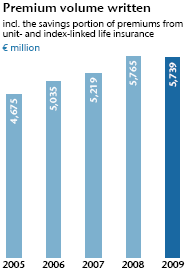

Taking into account the savings portion of the unit-linked and index-linked life insurance in the amount of € 728 million (2008: € 823 million), the total premium volume of the UNIQA Group remained nearly stable in 2009 at € 5,739 million (2008: € 5,765 million) despite the difficult economic conditions. The total consolidated premiums written even grew by 1.4% to € 5,012 million (2008: € 4,942 million). Due to the determination that a management contract previously held as an insurance contract poses no significant actuarial risk, the management fee will be reported under other income starting in 2009. The premiums written and retained, the insurance benefits and the operating expenses were therefore also corrected in the comparison figures from previous years. Developments were very positive in the area of insurance policies with recurring premium payments in particular, which grew 2.1% to € 4,885 million (2008: € 4,785 million). The single premium business, on the other hand, declined in 2009 by 12.8% to € 855 million (2008: € 980 million). The Group premiums earned including the savings portion of the unit-linked and index-linked life insurance (after reinsurance) in the amount of € 704million (2008: € 774 million) rose by 0.2% to € 5,474 million (2008: € 5,464 million). The retained premiums earned (according to IFRS) even increased by 1.7% to € 4,770 million (2008: € 4,690 million).

In the 2009 financial year, 42.6% (2008: 41.3%) of the premium volume arose in property and casualty insurance, 16.3% (2008: 15.7%) in health insurance and 41.1% (2008: 43.0%) in life insurance.

In Austria, premium volume written including the savings portion from the unit-linked and index-linked life insurance grew better the market average in 2009 at 4.9% to reach € 3,756 million (2008: € 3,579 million). Including the savings portion of the unit- and index-linked life insurance, the premiums earned rose by 6.3% to € 3,674 million (2008: € 3,457 million). The retained premiums earned (according to IFRS) in Austria amounted to € 3,074 million in 2009 (2008: € 2,971 million).

In the regions of Eastern and South Eastern Europe (CEE & EEM), the premium developments in 2009 were influenced by the difficult economic conditions and, in particular, by negative currency effects. The premium volume written including the savings portion from the unit-linked and index-linked life insurance fell in 2009 by 9.9% to € 1,153 million (2008: € 1,279 million). This put the share of Group premiums coming from CEE & EEM at 20.1% (2008: 22.2%). Including the savings portion from the unit-linked and index-linked life insurance, the premiums earned decreased by 9.4% to € 1,077 million (2008: € 1,188 million). The retained premiums earned (according to IFRS) were € 1,002 million (2008: € 1,073 million). Adjusted for the effects of the negative currency developments in 2009, however, the premium volume written in Eastern Europe grew by 4.0%.

In the Western European countries (WEM), the premium volume written including the savings portion from the unit-linked and index-linked life insurance fell in 2009 by 8.4% to € 830 million (2008: € 907 million). Here again, the single premium business was primarily responsible for the decline, falling by 25.1% to € 185 million (2008: € 247 million). Overall, the share in Group premiums therefore fell in 2009 to 14.5% (2008: 15.7%). Including the savings portion from the unit-linked and index-linked life insurance, the premiums earned decreased by 11.8% to € 723 million (2008: € 819 million). The retained premiums earned (according to IFRS), on the other hand, increased by 7.6% to € 695 million (2008: € 646 million).