Volatile yet rising international stock markets

In 2010, the international stock markets started out cautiously since economic indicators from the USA and Europe that were below expectations led to an initial consolidation. Only toward the beginning of March did positive business returns, a significant international increase in demand and on-going low interest rates lead to a brief yet strong recovery in the stock markets. However, the stock markets were not able to profit in the second quarter from the on-going dynamic economic recovery. Concerns about the stability of the euro and anticipated payment difficulties of Greece and other countries on the periphery of Europe dampened enthusiasm. The €750 billion rescue package quickly cobbled together by the EU and IMF for highly indebted European countries, as well as efforts by most European countries to consolidate their budgets, gradually calmed the markets and stopped the significant drop in the euro’s value.

After the currency and the stock market turbulence in the first half of the year, the third quarter passed in a comparative state of calm on the stock markets. Part of the calming effect arose from the fact that the proposals by the Basel Committee on Bank Supervision for regulating equity under Basel III were less strict and provided longer transition phases than initially assumed. An additional positive signal was the satisfactory rating of most European large banks in the stress tests by the Committee of European Bank Supervisors. In the fourth quarter, the stock markets generally recovered well against a backdrop of on-going low interest, positive economic data and business results that ranged from good to very good.

Overall, the DJ EURO STOXX 50, which is representative for Europe, lost approximately 6% of its value in 2010, whereas the DAX gained in value by more than 16%. The European insurance stocks under the umbrella of the DJ EURO STOXX Insurance also recorded a decrease of 6.7%. In the Far East, the NIKKEI 225 fell by 3%. Significant increases were experienced in the USA, both on the DOW JONES INDUSTRIAL AVERAGE by approximately 11% and the NASDAQ COMPOSITE by around 17%.

|

Information on UNIQA shares |

|

|

Securities abbreviation |

UQA |

|

Reuters |

UNIQ.VI |

|

Bloomberg |

UQA.AV |

|

ISIN |

AT0000821103 |

|

Market segment |

prime market of the Vienna Stock Exchange |

|

Trade segment |

Official trading |

|

Indices |

ATX Prime, WBI, VÖNIX |

|

Number of shares |

142,985,217 |

|

Standard & Poor’s rating |

A |

Vienna Stock Exchange continues to rise

In 2010, the Vienna Stock Exchange again grew perceptibly in value to continue its recovery from the previous year. The leading index, ATX (Austrian Traded Index), like nearly all the markets around the world, experienced indeed major volatility and had to accept a significant correction, especially in the second quarter. The ATX, which started the year at 2,537.00 points, reached its low point for the year at 2,216.24 points on 8 June 2010. This however was followed by an uninterrupted upward trend that lasted to the end of the year. At the end of 2010, the ATX was valued at 2,904.47 points, thereby achieving an overall increase in value of 16.4%. The market capitalisation of the Vienna Stock Exchange increased approximately €14 billion from the previous year to reach €91 billion.

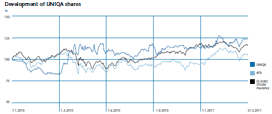

UNIQA shares surpass the overall market

The UNIQA shares listed on the prime market segment of the Vienna Stock Exchange was able to top the positive development of the overall Austrian market in 2010. The trend was partially volatile and was largely characterised by declines in the first quarter. The share opened at €12.81 on 4 January 2010, and by the end of March, it had reached its low for the year of €10.68. This was followed by a sharp upward trend which led the share to its high point for the year of €15.34 on 23 June. The second half of the year was essentially characterised by sideward movement including some significant fluctuations until the share concluded the year at €14.70, up 14.8% from the beginning of the year.