Highlights

2010 Fifth share repurchase programme

2008/09 Support of equity capital by two capital increases

2004 UNIQA corporate bond

2003 First online annual report

2001 First rating by Standard & Poor´s

2001 UNIQA in the prime market of the Vienna Stock Exchange

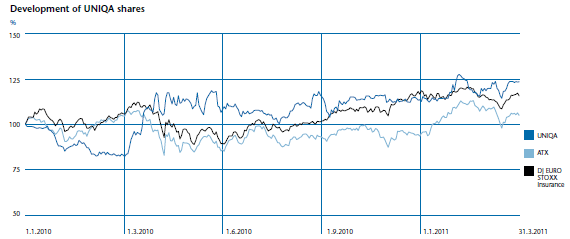

In a volatile yet generally positive capital market environment, UNIQA shares did very well in 2010 in comparison to the overall European market. A share repurchasing programme was started within the reporting period.

|

UNIQA key figures |

2010 |

2009 |

2008 |

2007 |

2006 | ||

| |||||||

|

Stock market price of UNIQA shares as at 31 Dec. |

14.70 |

12.97 |

18.06 |

20.95 |

25.09 | ||

|

High |

15.34 |

18.86 |

21.46 |

28.10 |

29.86 | ||

|

Low |

10.68 |

12.21 |

13.50 |

20.36 |

22.35 | ||

|

Average daily trading volume/day (€million) |

0.5 |

0.5 |

1.0 |

3.4 |

4.7 | ||

|

Market capitalisation as at 31 Dec. (€million) |

2,102 |

1,855 |

2,378 |

2,509 |

3,005 | ||

|

0.33 |

0.19 |

0.44 |

2.07 |

1.27 | |||

|

Dividend per share |

0.401) |

0.40 |

0.40 |

0.50 |

0.35 | ||