|

Figures in € million |

2013 |

2012 |

Change |

||||||||

|

|||||||||||

|

Premiums written |

5,157.6 |

4,864.2 |

+6.0 % |

||||||||

|

Savings portion of premiums from unit- and index-linked life insurance (gross before reinsurance) |

727.9 |

679.0 |

+7.2 % |

||||||||

|

Premiums written including the savings portion from unit- and index-linked life insurance |

5,885.5 |

5,543.1 |

+6.2 % |

||||||||

|

of which property and casualty insurance |

2,590.5 |

2,545.9 |

+1.8 % |

||||||||

|

of which health insurance |

937.6 |

909.1 |

+3.1 % |

||||||||

|

of which life insurance |

2,357.4 |

2,088.1 |

+12.9 % |

||||||||

|

of which recurring premiums |

1,674.6 |

1,554.6 |

+7.7 % |

||||||||

|

of which single-premium business |

682.8 |

533.5 |

+28.0 % |

||||||||

|

Premiums written including the savings portion from unit- and index-linked life insurance |

5,885.5 |

5,543.1 |

+6.2 % |

||||||||

|

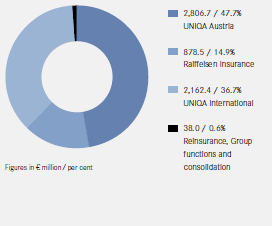

of which UNIQA Austria |

2,806.7 |

2,708.2 |

+3.6 % |

||||||||

|

of which Raiffeisen Insurance |

878.5 |

819.4 |

+7.2 % |

||||||||

|

of which UNIQA International |

2,162.4 |

1,942.8 |

+11.3 % |

||||||||

|

of which reinsurance |

1,633.1 |

1,280.0 |

+27.6 % |

||||||||

|

of which Group functions and consolidation |

–1,595.1 |

–1,207.2 |

+32.1 % |

||||||||

|

|

|

|

|

||||||||

|

Premiums earned (net)1) |

4,935.9 |

4,623.9 |

+6.7 % |

||||||||

|

of which property and casualty insurance |

2,438.8 |

2,394.4 |

+1.9 % |

||||||||

|

of which health insurance |

936.1 |

903.0 |

+3.7 % |

||||||||

|

of which life insurance |

1,560.9 |

1,326.5 |

+17.7 % |

||||||||

|

Savings portion of premiums from unit- and index-linked life insurance (net after reinsurance) |

702.3 |

649.9 |

+8.1 % |

||||||||

|

Premiums earned (net) including the savings portion of premiums from unit- and index-linked life insurance |

5,638.2 |

5,273.8 |

+6.9 % |

||||||||

|

|

|

|

|

||||||||

|

–3,955.3 |

–3,758.5 |

+5.2 % |

|||||||||

|

of which property and casualty insurance |

–1,633.8 |

–1,638.8 |

–0.3 % |

||||||||

|

of which health insurance |

–768.7 |

–756.5 |

+1.6 % |

||||||||

|

of which life insurance |

–1,552.7 |

–1,363.2 |

+13.9 % |

||||||||

|

|

|

|

|

||||||||

|

Operating expenses (net)2) |

–1,357.6 |

–1,319.3 |

+2.9 % |

||||||||

|

of which property and casualty insurance |

–803.4 |

–786.8 |

+2.1 % |

||||||||

|

of which health insurance |

–162.0 |

–138.6 |

+16.9 % |

||||||||

|

of which life insurance |

–392.2 |

–393.9 |

–0.4 % |

||||||||

|

Cost ratio (after reinsurance) |

24.1 % |

25.0 % |

– |

||||||||

|

|

|

|

|

||||||||

|

Combined ratio (after reinsurance) |

99.9 % |

101.3 % |

– |

||||||||

|

|

|

|

|

||||||||

|

Net investment income |

780.0 |

791.4 |

–1.4 % |

||||||||

|

|

|

|

|

||||||||

|

Profit from ordinary activities |

305.6 |

204.2 |

+49.7 % |

||||||||

|

Net profit/loss |

286.8 |

166.5 |

+72.3 % |

||||||||

|

Consolidated profit |

283.4 |

127.1 |

+123.0 % |

||||||||

|

|

|

|

|

||||||||

|

Return on equity (ROE) after taxes and minority interests |

11.9 % |

8.8 % |

– |

||||||||

|

|

|

|

|

||||||||

|

Investments3) |

27,383.6 |

26,326.0 |

+4.0 % |

||||||||

|

Equity |

2,767.7 |

2,009.3 |

+37.7 % |

||||||||

|

Total equity including minority interests |

2,789.9 |

2,030.0 |

+37.4 % |

||||||||

|

Technical provisions (net)4) |

24,183.9 |

23,759.3 |

+1.8 % |

||||||||

|

Total assets |

31,068.6 |

30,054.6 |

+3.4 % |

||||||||

|

|

|

|

|

||||||||

|

Number of insurance policies |

18,556,615 |

17,439,608 |

+6.4 % |

||||||||

|

Average number of employees |

14,277 |

14,795 |

–3.5 % |

||||||||

Premium volume written by operating segment 2013 |

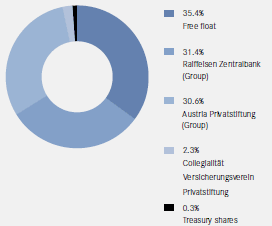

Shareholder structure of UNIQA Insurance Group AG |

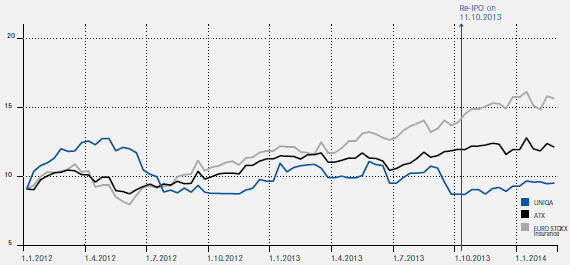

Development of UNIQA shares

Key figures for UNIQA shares

|

2013 |

2012 |

2011 |

2010 |

2009 |

|||

|

Figures in € |

|

|

|

|

|

||

|

|||||||

|

UNIQA’s share price on 31 December |

9.28 |

9.86 |

9.42 |

14.70 |

12.97 |

||

|

High |

11.14 |

13.40 |

16.50 |

15.34 |

18.86 |

||

|

Low |

8.12 |

8.75 |

9.00 |

10.68 |

12.21 |

||

|

Average turnover/day (in € million) |

1.5 |

0.1 |

0.1 |

0.5 |

0.5 |

||

|

Market capitalisation as at 31 December (in € million) |

2,867.5 |

2,112.5 |

1,346.9 |

2,102.0 |

1,855.0 |

||

|

1.20 |

0.75 |

–1.73 |

0.30 |

0.19 |

|||

|

Dividend per share |

0.351) |

0.25 |

0 |

0.40 |

0.40 |

||