The year 2015 was yet again the best year in our company’s history. However, we see it not as a reason for premature rejoicing, but rather as an opportunity to extend our gratitude to you as our shareholders for your loyalty and to all our employees for their huge commitment. It is time to provide you with a candid and personal interim account of the past five years.

Five years ago, in summer 2011, we presented you with our long-term strategy programme UNIQA 2.0 that was scheduled to run until 2020:

- What is our goal? To double the number of customers to 15 million.

- How do we intend to achieve it? By focusing on our core competencies as a direct insurer in our two core markets, Austria and Central and Eastern Europe (CEE).

- Where do we want to improve? At UNIQA Austria in profitability, at Raiffeisen Insurance in productivity, at UNIQA International in terms of profitable growth in the existing markets, and across the Group – in view of Solvency II – in our risk/return profile.

- What does it take? A significant capital increase on the stock exchange and a corporate structure that bears in mind the needs of the capital market.

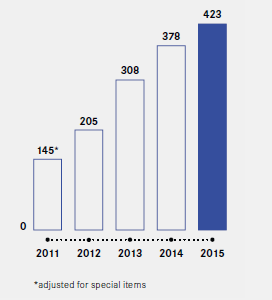

- Why is that beneficial to our shareholders? Because we want to increase earnings before taxes: from about €145 million in 2010 to up to €400 million by 2015.

Hard work – many goals achieved

My self-critical review today, in spring of 2016 – and thus roughly halfway through UNIQA 2.0 – is underpinned by the conviction that together we, i.e. as a team of more than 21,000 employees and partners, have achieved through hard work most of the goals we set ourselves in 2011. Most of them, – but not all:

- As of 31 December 2015, we have more than 10 million customers, which means that we have gained the trust of a net additional 2.5 million customers. If we were to assume a linear path in achieving our target of 15 million by 2020, we should already have 11.25 million customers by now. We have been unable to achieve that number due to the highly subdued growth rate of the Eastern European insurance market in the past five years. Over that period, our 15 CEE markets have grown by about €10 billion less than we had anticipated in 2011.

- Across our company, the focus on the core competency as direct insurer has become more noticeable in our two core markets, Austria and CEE, over the past five years. This has not gone quite as fast as we had had in mind, but we are well on our way. As shareholders, you have been able to follow this development in the past five years: wherever investments were not in accordance with our strategy, either in terms of the kind of business or its regional focus, we have parted with them: Mannheimer Versicherung in Germany, as well as the hotel and media investments. On the other hand, we invested (and will continue to do so) in areas that would strengthen our two core markets: for example, we acquired insurance companies in Croatia and Serbia and invested in private hospitals in Austria.

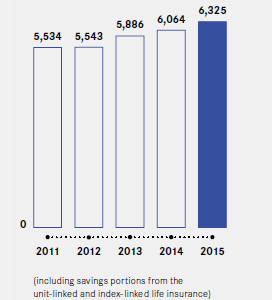

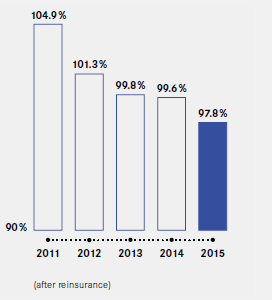

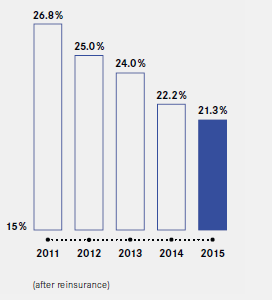

What might not be fully obvious to you as shareholders, but what is also happening within the Group, is the shift in corporate culture: we announced in 2011 that we were highly committed to focusing exclusively on our core business and since then we have gradually directed more attention to our direct insurance business. This probably sounds to you like it should go without saying, or indeed like something that as shareholders you could expect from us anyway. You are right, of course. But it has not been (and still is not) that easy for our team, given that we are talking about the transformation of an insurance group that has existed for 200 years. Yet, the adage that all our resources are always limited and that we therefore have to focus on areas that create sustainable value for our owners has turned out to be right. The positive development of the technical result in recent years, which I will discuss further down, testifies to this fact. I really do believe that in the past five years we have become noticeably more open, performance-oriented, better and faster, and that this is why we also have managed to attract numerous new, young talents. But I also know that there is still room for improvement across all areas; in fact, substantial room in some of them. - As a consequence of our core programme – the increase in profitability of UNIQA Austria, increased productivity at Raiffeisen Insurance, focus on profitable growth at UNIQA International and improvement of our risk/return profile in preparation for Solvency II – we recorded a growth rate of about 14 per cent in our top line, i.e. premiums, from 2011 to 2015. During the same period, we gradually cut our combined ratio from 105 per cent to 97.8 per cent and the net admin cost ratio from 14.6 per cent to 9.8 per cent. This means that in our core business, underwriting, we are making substantially more money today than we used to (personally, I would say this is still not enough, given that our target value for the combined ratio in 2020 is 95 per cent). This increase in revenues was possible, among other things, due to the fact that UNIQA Austria’s health insurance business, the backbone of our Group, was and is still highly profitable, and because life insurance was also (still) generating high revenues during that period.

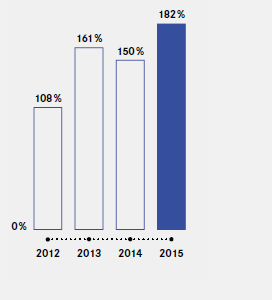

- Strengthening our thin capital base from 2011 has been our biggest worry in the past few years, and our greatest challenge. As a result of our consistent risk management, the re-IPO of more than €750 million (gross) in October 2013, and the placement of a subordinated capital bond (Tier 2) of €500 million in summer 2015, our economic capital ratio amounted to a strong 182.2 per cent at the end of 2015. All that in spite of the fact that we are not applying any of the transitional regulations and we are one of the few insurance companies in Europe that does not classify government bonds as risk-free, which is why we hold over €500 million as risk capital.

- As a result, in 2015 we managed to increase group earnings before taxes over the years from roughly €145 million to €423 million. Therefore, I think, we have also been able to offer you, our shareholders, an attractive dividend policy over this period. Personally, I am a bit irritated that we did not manage to attain our original goal of 2011, i.e. to boost earnings before taxes by up to €400 million to about €550 million. However, this has been largely outside of our sphere of influence due to the growth rate in the Eastern European insurance markets falling short of expectations and due to the sustainably low interest rates.

|

Premiums written  |

|

Combined Ratio  |

Economic capital ratio (ECR)  |

|

Cost ratio  |

Earnings before taxes  |

The kick-off for the second half of UNIQA 2.0, i.e. the period of 2016 to 2020, has been made in a highly exciting and interesting environment. We believe that the insurance industry is about to face some of the biggest shifts in its history.

Second half bringing huge challenges

On the one hand, the tense economic situation on the capital markets with historically low interest rates and the resulting massively negative impact on parts of the traditional business model and on investment income represents the biggest challenge in the “old economy”, i.e. in the existing business model. In addition, we have to compensate for the growing volume of expenses that result from the rising number of regulatory provisions and we are also expecting a rather moderate economic growth rate for the time being. But lamenting this state of affairs is of no use and a waste of energy. The relevant question is: how do we react to the situation proactively?

On the other hand, while we are already expecting strong headwinds from outside, our industry – so far insular and resistant to change – is all of a sudden finding itself within massive changes in customer expectations and needs. The history of other industries is testament to the fact that the omnipresence of digitalisation across all areas of life is capable of eliminating or at least eroding business models in a disruptive and brutal fashion, and to the speed at which insufficiently agile market participants can lose ground. This trend will not stop at the insurance sector, and we are preparing for it actively and with a strong focus.

Investment in digitalisation

We believe that we must meet these challenges – not in a half-hearted fashion, treating them like compulsory exercises, but rather we must embrace them as big opportunities. The only way to do this is to transform our core business: from a provider of insurance products to an integrated service provider that picks up their customers where they stand in their individual “environment of needs”, where they intuitively expect safety and services relating to it.

In order to set off the paradigm shift required for this surge of innovation, we have launched the largest renewal programme in our history and will invest a total of about €500 million in our future. These investments, a large part of which will already be flowing in 2016, are mostly earmarked for the “re-design” of our business model, for the creation of competence in terms of personnel and the necessary IT systems. In order to push the digitalisation of our business forward, a Chief Digital Officer, a Chief Data Officer and a Chief Innovation Officer will be reporting directly to the Group Management Board.

With new governance into the future

We have decided in favour of a new, streamlined group structure so as to boost the development of our operating excellence in our core business – which we urgently need in order to be able to afford the capital outlay – and to focus our energy on our customers and the necessary innovation leap. We will streamline the listed holding UNIQA Insurance Group AG by reducing the number of board members from five to three. We will also merge the four direct insurers currently operating on the Austrian market, UNIQA Österreich Versicherungen AG, Raiffeisen Versicherung AG, FinanceLife Lebensversicherung AG and Salzburger Landes-Versicherung AG, with UNIQA Österreich Versicherungen AG acting as the acquiring entity. We will reduce the number of board members in Austria from 22 to 10. This will create a structure where the board members will assume responsibilities across the Group, making the UNIQA Group overall more effective, efficient and innovative.

Progressive dividend policy in spite of the investment programme

Even though earnings before taxes in 2016 will be as much as 50 per cent below the excellent result of 2015 due to the substantial investments we are making for the future, and even though the economic outlook is still moderate and interest rates remain low, we nevertheless want to further increase dividends per share this year. Supported by sustainable cash flows and high operating profitability in our core business, UNIQA intends to gradually step up its annual dividend payout per share within the framework of a progressive dividend policy from 2016 to 2020. We believe that our profitability, which has improved drastically since 2011, and our healthy equity position provide us with the means, on the one hand, to carry out the necessary long-term investments for the future while on the other hand providing our shareholders with the outlook of an attractive dividend policy without – and this is a prerequisite for me – eroding the substance of the company in the process.

On behalf of the entire Management Board, I would like to thank you, ladies and gentlemen, for your commitment to UNIQA. I can assure you that we will push forward the development of your and our UNIQA in spite of, or perhaps because of the big challenges ahead with personal enthusiasm, consistency and entrepreneurial expertise. We will continue to focus on fulfilling your expectations and remaining worthy of your trust.

Sincerely,

Andreas Brandstetter

CEO UNIQA Group