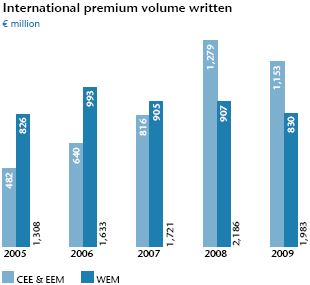

The international premium volume of the UNIQA Group (including the savings portion from unit-linked and index-linked life insurance) fell in 2009 by 9.3% to € 1,983 million (2008: € 2,186 million) as a result of the difficult economic conditions and the negative currency developments in Eastern and South Eastern Europe. This brought the international share of Group premiums up to 34.6% (2008: 37.9%).

Including the savings portion from the unit-linked and index-linked life insurance (after reinsurance), the premiums earned decreased by 10.4% to € 1,800 million (2008: € 2,008 million). On the other hand, the retained premiums earned (according to IFRS) declined only slightly by 1.3% to € 1,697 million (2008: € 1,719 million).

The premium volume written including the savings portion of the unit- and index-linked life insurance was divided as follows among the various regions in the UNIQA Group:

| (XLS:) Download Excel |

|

UNIQA international markets |

Premiums written1) |

Share of Group premiums | ||||||

|

|

2009 |

2008 |

2007 |

2006 |

2005 |

2009 | ||

| ||||||||

|

Central Eastern Europe (CEE) |

912 |

1,115 |

735 |

595 |

482 |

15.9% | ||

|

Eastern Emerging Markets (EEM) |

241 |

164 |

81 |

45 |

0 |

4.2% | ||

|

Western European Markets (WEM) |

830 |

907 |

905 |

993 |

826 |

14.5% | ||

|

Total international |

1,983 |

2,186 |

1,721 |

1,633 |

1308 |

34.6% | ||

Total insurance benefits in the international group companies fell slightly by 0.3% in 2009 to € 1,231 million (2008: € 1,235 million). The consolidated operating expenses less reinsurance commissions and profit shares from reinsurance business ceded remained at the level of the previous year at € 517 million (2008: € 517 million). Before consolidation based on the geographic segments (cf segment reports), the profit on ordinary activities generated by the companies in the three regions outside of Austria amounted to € 16 million (2008: € 86 million) in 2009. This decline can be attributed in particular to lower results by the companies in Italy, Bulgaria, Romania and Hungary.