Premium development

The life insurance premiums written including the savings portion from the unit-linked and index-linked life insurance fell in 2009 by 4.9% to € 2,356 million (2008: € 2,476 million), in particular due to the declining single premium business in the area of unit-linked life insurance. Revenues from policies with recurring premium payments rose by 0.3% to € 1,501 million (2008: € 1,496 million). Revenue in the single premium business in the area of unit-linked life insurance fell by 23.5% to € 362 million (2008: € 473 million). Classic single premiums, on the other hand, declined only slightly by 2.7% to € 493 million (2008: € 507 million). Overall, the single premium business declined by 12.8% to € 855 million (2008: € 980 million).

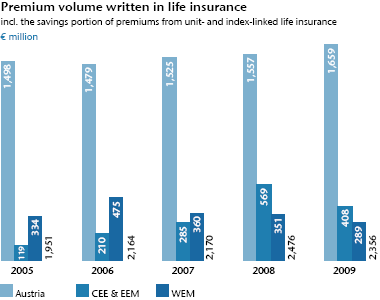

The premium developments in Austria were very satisfactory in 2009 due to the further growth in the area of unit-linked life insurance products. The premium volume grew by 6.5% to € 1,659 million (2008: € 1,557 million). Revenues from policies with recurring premium payments declined slightly by 1.1% to € 1,240 million (2008: € 1,255 million). The single premium business grew by 38.5% to € 418 million (2008: € 302 million). The life insurance business of the Group companies in the Central and Eastern European regions (CEE & EEM) declined in 2009 due to the continued difficult economic conditions. The premium volume written including the savings portion from the unit-linked and index-linked life insurance was taken back by 28.2% to € 408 million (2008: € 569 million). This brought the share of life insurance from these countries to 17.3% in 2009 (2008: 23.0%). In the Western European countries, the premium volume also declined by 17.6% to € 289 million (2008: € 351 million). Overall, the Western European region (WEM) contributed 12.3% (2008: 14.2%) to the total life insurance premiums of the Group.

The risk premium share of unit-linked and index-linked life insurance included in the consolidated financial statements totalled € 105 million in 2009 (2008: € 97 million). The savings portion of the unit-linked and index-linked life insurance lines amounted to € 728 million (2008: € 823 million) and was, in accordance with FAS 97 (US-GAAP), balanced out by the changes in the actuarial provision.

Including the savings portion of the unit-linked and index-linked life insurance (after reinsurance) in the amount of € 704 million (2008: € 774 million), the premiums earned in life insurance declined by 4.0% to € 2,250 million (2008: € 2,344 million). On the other hand, the retained premiums earned (according to IFRS) fell by just 1.5% in 2009 to € 1,546 million (2008: € 1,570 million).

| (XLS:) Download Excel |

|

Life |

2009 |

2008 |

2007 |

2006 |

2005 |

|

Premiums written |

1,628 |

1,653 |

1,422 |

1,605 |

1,591 |

|

Savings portion of premiums from unit- and index-linked life insurance |

728 |

823 |

748 |

559 |

360 |

|

Premiums written incl. savings portion of premiums from unit- and index-linked life insurance |

2,356 |

2,476 |

2,170 |

2,164 |

1,951 |

|

Share CEE & EEM |

17.3% |

23.0% |

13.1% |

9.7% |

6.1% |

|

Share WEM |

12.3% |

14.2% |

16.6% |

22.0% |

17.1% |

|

International share |

29.6% |

37.2% |

29.7% |

31.7% |

23.2% |

|

Premiums earned (net) |

1,546 |

1,570 |

1,342 |

1,527 |

1,523 |

|

Savings portion of premiums from unit- and index-linked life insurance (net after reinsurance) |

704 |

774 |

695 |

499 |

311 |

|

Premiums earned (net) incl. the savings portion of premiums from unit- and index-linked life insurance |

2,250 |

2,344 |

2,037 |

2,027 |

1,834 |

|

Net investment income |

525 |

133 |

563 |

610 |

731 |

|

Insurance benefits (net) |

–1,690 |

–1,328 |

–1,534 |

–1,780 |

–1,898 |

|

Other operating expenses less reinsurance commissions |

–341 |

–363 |

–321 |

–261 |

–244 |

|

Cost ratio (net after reinsurance) |

15.1% |

15.5% |

15.7% |

12.9% |

13.3% |

|

Profit on ordinary activities |

2 |

–27 |

5 |

56 |

69 |

|

Net profit |

–2 |

–37 |

4 |

37 |

44 |

Developments in insurance benefits

The retained insurance benefits increased in the reporting year by 27.3% to € 1,690 million (2008: € 1,328 million) primarily due to the change in deferred profit sharing as a result of the clear improvement in capital income according to IFRS. The additions increased in 2009 compared to the previous year by about € 382 million. Insurance benefits also increased in Austria by 41.9% to € 1,189 million (2008: € 838 million). In the Western European region (WEM), insurance benefits grew by 110.8% to € 221 million (2008: € 105 million), while they fell in Central and Eastern Europe (CEE & EEM) by 27.1% to € 281 million (2008: € 385 million).

Operating expenses

Total operating expenses in life insurance less reinsurance commissions and profit shares from reinsurance business ceded fell in 2009 by 6.1% to € 341 million (2008: € 363 million). Acquisition expenses decreased by 10.4% to € 257 million (2008: € 286 million). Other operating expenses increased by 9.8% to € 84 million in 2009 (2008: € 76 million). As a result of this development, the cost ratio in life insurance, i.e. the relation of all operating expenses to the Group premiums earned, including the savings portion from the unit-linked and index-linked life insurance (after reinsurance), fell to 15.1% (2008: 15.5%).

Investment results

Net investment income less financing costs rose in the reporting year by 295.7% to € 525 million (2008: € 133 million). The capital investments including the investments for unit-linked and index-linked life insurance grew in 2009 by 8.2% to € 17,028 million (2008: € 15,739 million).

Profit on ordinary activities, net profit

The profit on ordinary activities in life insurance was once again positive in 2009, rising by € 29 million to € 2 million (2008: € –27 million). Net profit increased was € –2 million (2008:

€ –37 million).