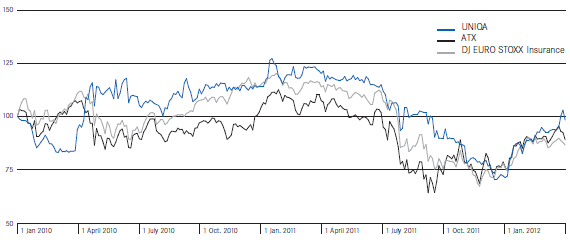

UNIQA shares recorded a significant decline in 2011. Of course the conditions on the European stock exchanges were generally difficult last year, but we are still unhappy about the price development of our shares. We are working hard to get UNIQA ready for a re-IPO and to significantly improve the performance of the shares and the company.

UNIQA shares, listed on the prime market of the Vienna Stock Exchange, fell by 35.9 per cent in 2011. This means its performance was in line with that of the leading index in Vienna, i.e. the ATX, which recorded a decrease of 34.9 per cent, but we are very unsatisfied with this development: for example, the DJ EURO STOXX Insurance index lost only 18.6 per cent over the same period of time.

|

Key ratios for UNIQA shares |

2011 |

2010 |

2009 |

2008 |

2007 | ||

|

Figures in € |

|

|

|

|

| ||

| |||||||

|

Price of UNIQA shares on 31 Dec. |

9.42 |

14.70 |

12.97 |

18.06 |

20.95 | ||

|

High |

16.50 |

15.34 |

18.86 |

21.46 |

28.10 | ||

|

Low |

9.00 |

10.68 |

12.21 |

13.50 |

20.36 | ||

|

Average turnover/day (in € millions) |

0.1 |

0.5 |

0.5 |

1.0 |

3.4 | ||

|

Market capitalisation as at 31 Dec. (millions) |

1,347 |

2,102 |

1,855 |

2,378 |

2,509 | ||

|

Result per share |

–1.73 |

0.30 |

0.19 |

0.44 |

2.07 | ||

|

Dividend per share |

01) |

0.40 |

0.40 |

0.40 |

0.50 | ||