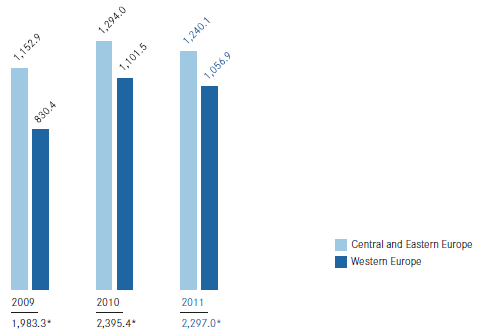

Premium development

The international premium volume of the UNIQA Group (including the savings portion of unit- and index-linked life insurance) fell by 4.1 per cent to € 2,297 million in 2011 (2010: € 2,395.4 million) as a result of the development of single premiums. The international share of Group premiums therefore remained almost unchanged year-on-year at 38.4 per cent (2010: 38.5 per cent).

Including the savings portion of unit- and index-linked life insurance (after reinsurance), premiums earned decreased by 4.7 per cent to € 2,109.7 million (2010: € 2,212.9 million). Retained premiums earned (in accordance with IFRS) fell by 3.2 per cent to € 1,972.6 million (2010: € 2,038.5 million).

International premium volume written

Figures in € million

In Central Europe (CE) – Poland, Slovakia, the Czech Republic and Hungary – premiums written fell by 9.0 per cent to € 868.3 million (2010: € 954.5 million). In Eastern Europe (EE) – which consists of Romania and Ukraine – premiums written remained at the prior-year level at € 157.6 million (2010: 158.4 million). In Southeastern Europe (SEE) – Albania, Bosnia and Herzegovina, Bulgaria, Kosovo, Croatia, Macedonia, Montenegro and Serbia – 2011 saw highly encouraging growth of 10.6 per cent to € 187.4 million (2010: € 169.3 million). The strongest premium growth was generated in the Russian market (RU), where premiums increased by 128.2 per cent to € 26.8 million (2010: € 11.7 million).

All in all, the Group’s premiums in Central and Eastern Europe fell by 4.2 per cent to € 1,240.1 million (2010: € 1,294.0 million). Recurring premiums enjoyed extremely positive development in 2011, increasing by 7.7 per cent to € 1,095.3 million (2010: € 1,017.0 million). However, single premium business declined strongly, particularly in Poland, falling by 47.7 per cent to € 144.8 million (2010: € 277.0 million). Central and Eastern Europe’s share of Group premiums amounted to 20.7 per cent (2010: 20.8 per cent) in the 2011 financial year.

In Western Europe (WE) – Germany, Italy, Liechtenstein and Switzerland – the business volume fell by 4.0 per cent to € 1,056.9 million (2010: € 1,101.5 million). Recurring premiums in this region also experienced very strong growth, however, climbing by 9.5 per cent to € 740.0 million (2010: € 676.0 million). Due to the deterioration in Italy, single premiums fell by 25.5 per cent to € 316.9 million (2010: € 425.4 million). Western Europe’s share of Group premiums amounted to 17.7 per cent in 2011 (2010: 17.7 per cent).

Accordingly, the Group’s level of internationalisation at year-end 2011 was 38.4 per cent (2010: 38.5 per cent).

The premium volume written including the savings portion of unit- and index-linked life insurance was broken down among the individual regions of the UNIQA Group as follows:

|

UNIQA Group international markets |

Premiums written1) |

Share of Group premiums | ||||

|

Figures in € million |

2011 |

2010 |

2009 |

2011 | ||

| ||||||

|

Central Europe (CE) |

868.3 |

954.5 |

863.5 |

14.5 % | ||

|

Eastern Europe (EE) |

157.6 |

158.4 |

167.1 |

2.6 % | ||

|

Southeastern Europe (SEE) |

187.4 |

169.3 |

122.1 |

3.1 % | ||

|

Russia (RU) |

26.8 |

11.7 |

0.1 |

0.4 % | ||

|

Western Europe (WE) |

1,056.9 |

1,101.5 |

830.4 |

17.7 % | ||

|

Total international markets |

2,297.0 |

2,395.4 |

1,983.3 |

38.4 % | ||

Development of insurance benefits

Total retained insurance benefits at the international Group companies fell by 11.8 per cent to € 1,508.1 million in 2011 (2010: € 1,709.3 million).

In Central Europe, benefits declined by 30.4 per cent to € 457.0 million (2010: € 656.8 million) due in particular to the lower level of single premium business in the life insurance segment. In Eastern Europe, benefits remained largely unchanged year-on-year at € 110.9 million (2010: € 109.5 million). In Southeastern Europe, insurance benefits increased by 9.7 per cent to € 102.4 million (2010: € 93.3 million), while the figure for Russia amounted to € 14.3 million (2010: € 6.5 million). In the Western European region, the benefit volume fell by 2.3 per cent to € 823.5 million (2010: € 843.1 million).

Operating expenses

Operating expenses at the international Group companies less reinsurance commission received rose by 8.8 per cent to € 624.4 million in 2011 (2010: € 573.6 million).

In Central Europe, operating expenses increased by 9.1 per cent to € 244.1 million (2010: € 223.7 million), while the figure for Eastern Europe rose slightly by 8.5 per cent to € 65.1 million (2010: € 60.0 million). In Southeastern Europe, operating expenses increased by 14.1 per cent to € 78.4 million (2010: € 68.8 million). In Russia, operating expenses climbed to € 16.4 million in the 2011 financial year (2010: € 8.3 million), while expenses in Western Europe increased by 3.5 per cent to € 220.3 million (2010: € 212.8 million).

Investment result

Net investment income at the international Group companies fell by 10.3 per cent to € 122.8 million in 2011 (2010: € 136.9 million) due to write-downs on Greek bonds and the negative developments on the financial markets. While the investment result in Western Europe increased by 8.6 per cent to € 77.3 million (2010: € 71.1 million), the investment result in Central and Eastern Europe fell by 30.7 per cent to € 45.5 million (2010: € 65.7 million).

Profit/loss on ordinary activities

Before consolidation based on the geographic segments (see Segment Income Statement), the loss on ordinary activities generated by the companies in the three regions outside of Austria in 2011 amounted to minus € 36.7 million (2010: minus € 66.2 million). The loss before taxes in Central and Eastern Europe improved to minus € 27.9 million despite challenging economic conditions (2010: minus € 34.9 million). In Western Europe, the pre-tax loss in the 2011 financial year amounted to minus € 8.8 million (2010: minus € 31.2 million).