Premium development

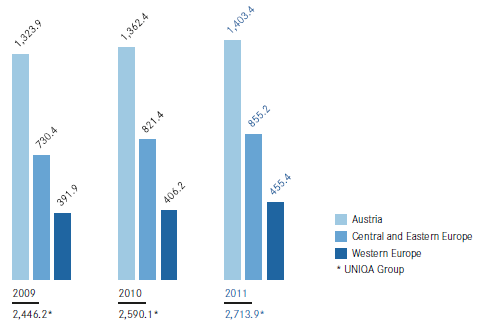

In the property and casualty insurance segment, the UNIQA Group also enjoyed successful growth in 2011, increasing its premiums written by 4.8 per cent to € 2,713.9 million (2010: € 2,590.1 million). The premium volume in Austria increased by 3.0 per cent to € 1,403.4 million (2010: € 1,362.4 million).

The growth recorded in the previous years in Central and Eastern Europe also continued. Premiums written increased by 4.1 per cent to € 855.2 million (2010: € 821.4 million), thereby contributing 31.5 per cent (2010: 31.7 per cent) to Group premiums in the property and casualty insurance segment.

In the Western European markets, the premium volume written increased by 12.1 per cent to € 455.4 million in 2011 (2010: 406.2 million) on the back of the very strong growth in Italy and Germany. Western Europe accounted for 16.8 per cent of Group premiums (2010: 15.7 per cent). Overall, the international share of Group premiums in the property and casualty insurance segment amounted to 48.3 per cent (2010: 47.4 per cent).

Premium volume written in property and casualty insurance

Figures in € million

Details on the premium volume written in the most important risk classes can be found in the Notes to the Consolidated Financial Statements (Note 31).

Retained premiums earned (in accordance with IFRS) in the property and casualty insurance segment totalled € 2,556.4 million in the year under review (2010: € 2,431.1 million), representing an increase of 5.2 per cent.

|

Property and casualty insurance |

2011 |

2010 |

2009 |

|

Figures in € million |

|

|

|

|

Premiums written |

2,713.9 |

2,590.1 |

2,446.2 |

|

Share Central and Eastern Europe |

31.5 % |

31.7 % |

29.9 % |

|

Share Western Europe |

16.8 % |

15.7 % |

16.0 % |

|

International share |

48.3 % |

47.4 % |

45.9 % |

|

Premiums earned (net) |

2,557.0 |

2,433.3 |

2,290.1 |

|

Net investment income |

50.6 |

91.3 |

117.7 |

|

Insurance benefits (net) |

–1,741.4 |

–1,740.8 |

–1,552.3 |

|

Loss ratio (after reinsurance) |

68.1 % |

71.6 % |

67.8 % |

|

Loss ratio (before reinsurance) |

66.1 % |

69.3 % |

69.7 % |

|

Other operating expenses less reinsurance commission |

–945.2 |

–822.1 |

–799.8 |

|

Cost ratio (after reinsurance) |

37.0 % |

33.8 % |

34.9 % |

|

Cost ratio (before reinsurance) |

35.6 % |

32.5 % |

33.3 % |

|

Combined ratio (after reinsurance) |

105.1 % |

105.4 % |

102.7 % |

|

Combined ratio (before reinsurance) |

101.7 % |

101.8 % |

103.0 % |

|

Profit/loss on ordinary activities |

–136.9 |

–47.3 |

–5.2 |

|

Net profit/loss |

–63.0 |

–50.1 |

–20.4 |

|

Consolidated profit/loss |

–63.1 |

–50.4 |

–19.4 |

Development of insurance benefits

Total retained insurance benefits remained essentially unchanged year-on-year at € 1,741.4 million (2010: € 1,740.8 million) despite the strong growth in premiums; this was attributable to the good development of claims and the fact that there were no natural disasters.

In Austria, insurance benefits in the property and casualty insurance segment rose by 3.2 per cent to € 934.2 million (2010: € 905.0 million), while the figure for the Western European markets increased by 8.6 per cent to € 300.6 million (2010: € 276.8 million). In the Central and Eastern European countries, on the other hand, insurance benefits dropped by 9.4 per cent to € 506.5 million (2010: € 559.0 million).

As a result of this development, the net loss ratio (retained insurance benefits as a proportion of premiums earned) fell by 3.5 percentage points to 68.1 per cent (2010: 71.6 per cent). The gross loss ratio (before reinsurance) at year-end 2011 was 66.1 per cent (2010: 69.3 per cent), an improvement of 3.2 percentage points.

In contrast, the net loss ratio in Austria fell to 67.4 per cent in the past financial year (2010: 67.6 per cent), while the figure for Central and Eastern Europe was as low as 64.5 per cent (2010: 74.8 per cent) thanks to the positive development of claims. The Western European companies recorded a net loss ratio of 78.0 per cent (2010: 80.4 per cent) for 2011.

Operating expenses, combined ratio

Total operating expenses in the property and casualty insurance segment less reinsurance commission and profit shares from reinsurance business ceded rose by 15.0 per cent to € 945.2 million (2010: € 822.1 million). At the same time, acquisition costs increased by 5.5 per cent to € 572.4 million (2010: € 542.4 million), while other operating expenses rose by 33.3 per cent to € 372.8 million (2010: € 279.8 million) due to the non-recurring expenses in connection with the Group’s repositioning.

In Austria, operating expenses in the property and casualty insurance segment rose by 25.0 per cent to € 495.5 million (2010: € 396.4 million); in Central and Eastern Europe, they increased by 6.1 per cent to € 298.7 million (2010: € 281.5 million), while the figure for the Western European markets rose by 4.6 per cent to € 151.0 million (2010: € 144.3 million).

The cost ratio in the property and casualty insurance segment (after reinsurance) increased to 37.0 per cent in the past financial year (2010: 33.8 per cent) as a result of this development.

The net combined ratio decreased on the back of the improved development of claims, amounting to 105.1 per cent in 2011 (2010: 105.4 per cent). Adjusted for the aforementioned non-recurring expenses in connection with the Group’s repositioning, the net loss cost ratio was 101.0 per cent. The combined ratio before reinsurance improved slightly to 101.7 per cent (2010: 101.8 per cent).

Investment result

Net investment income fell by 44.6 per cent to € 50.6 million in the past financial year (2010: 91.3 million). Investments in property and casualty insurance declined by 0.9 per cent to € 3,171.4 million (2010: € 3,200.4 million).

Profit/loss on ordinary activities, net profit/loss, consolidated profit/loss

The loss on ordinary activities in property and casualty insurance deteriorated to minus € 136.9 million in 2011 due to the developments described above (2010: minus € 47.3 million). The net loss amounted to minus € 63.0 million (2010: minus € 50.1 million), while the consolidated loss after taxes and minority interests amounted to minus € 63.1 million (2010: minus € 50.4 million).