Premium development

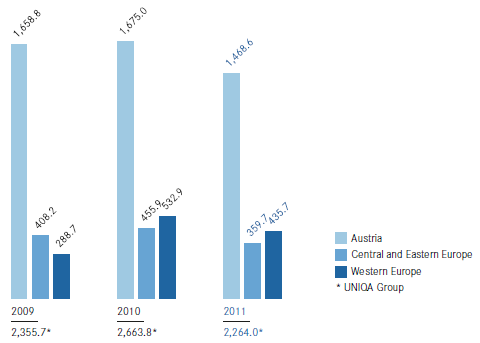

In 2011, the premium volume written in the life insurance segment including the savings portion of unit- and index-linked life insurance fell by 15.0 per cent to € 2,264.0 million (2010: € 2,663.8 million) due to the downturn in the area of single premium business in Austria, Poland and Italy. On the other hand, premiums from policies with recurring premium payments grew by 5.2 per cent to € 1,662.3 million (2010: € 1,580.1 million). The aforementioned deterioration in the single premium business saw premiums falling by 44.5 per cent to € 601.7 million (2010: € 1,083.7 million). Traditional single premiums declined by 34.6 per cent to € 423.2 million (2010: € 647.0 million), while single premiums in the area of unit-linked life insurance fell by 59.1 per cent to € 178.4 million (2010: € 436.7 million).

Premium volume written in life insurance

Including the savings portion of premiums from unit- and indexlinked life insurance

Figures in € million

Premium development in Austria was highly satisfactory in 2011, particularly in the area of products with recurring premiums. Revenues from these policies increased by 2.7 per cent to € 1,328.6 million (2010: € 1,293.7). The single premium business, on the other hand, fell by 63.3 per cent to € 140.0 million (2010: € 381.3 million) due to the extension of the minimum holding period to benefit from tax advantages from ten to 15 years. All in all, the life insurance premium volume in Austria decreased by 12.3 per cent to € 1,468.6 million (2010: € 1,675.0 million).

The life insurance business of the Group companies in the Central and Eastern European regions also decreased in 2011. The premium volume written including the savings portion of unit- and index-linked life insurance declined by 21.1 per cent to € 359.7 million (2010: € 455.9 million). While single premiums fell by 47.7 per cent to € 144.8 million (2010: € 277.0 million), recurring premiums showed extremely satisfactory development, rising by 20.1 per cent to € 214.9 million (2010: € 178.9 million). All in all, the share of life insurance attributable to these countries amounted to 15.9 per cent in 2011 (2010: 17.1 per cent).

In the Western European countries, the premium volume decreased by 18.2 per cent to € 435.7 million (2010: € 532.9 million) due to the downturn in business in Italy and Liechtenstein. Single premiums in this region also fell by 25.5 per cent to € 316.9 million (2010: € 425.4 million); however, recurring premiums rose by 10.6 per cent to € 118.8 million (2010: € 107.5 million). All in all, the Western Europe region thus contributed 19.2 per cent (2010: 20.0 per cent) to the total life insurance premiums of the Group.

The risk premium share of the unit- and index-linked life insurance included in the Consolidated Financial Statements totalled € 139.1 million in 2011 (2010: € 131.8 million). The savings portion contained in the premiums of the fund- and index-linked life insurance segments amounted to € 633.9 million (2010: € 845.1 million) and was offset against the changes in actuarial provisions in accordance with FAS 97 (US-GAAP).

Including the savings portion of unit- and index-linked life insurance (after reinsurance) in the amount of € 599.7 million (2010: € 823.1 million), premiums earned in the life insurance segment fell by 16.1 per cent to € 2,150.9 million (2010: € 2,564.5 million). Retained premiums earned (in accordance with IFRS) decreased by 10.9 per cent to € 1,551.2 million in 2011 (2010: € 1,741.4 million).

|

Life insurance |

2011 |

2010 |

2009 |

|

Figures in € million |

|

|

|

|

Premiums written |

1,630.1 |

1,818.7 |

1,628.0 |

|

Savings portion of premiums from unit- and index-linked life insurance |

633.9 |

845.1 |

727.7 |

|

Premiums written including the savings portion of premiums from unit- and index-linked life insurance |

2,264.0 |

2,663.8 |

2,355.7 |

|

Recurring premiums |

1,662.3 |

1,580.1 |

1,501.1 |

|

Single premiums |

601.7 |

1,083.7 |

854.6 |

|

Share Central and Eastern Europe |

15.9 % |

17.1 % |

17.3 % |

|

Share Western Europe |

19.2 % |

20.0 % |

12.3 % |

|

International share |

35.1 % |

37.1 % |

29.6 % |

|

Premiums earned (net) |

1,551.2 |

1,741.4 |

1,546.2 |

|

Savings portion of premiums from unit- and index-linked life insurance (after reinsurance) |

599.7 |

823.1 |

703.6 |

|

Premiums earned including the savings portion of premiums from unit- and index-linked life insurance (after reinsurance) |

2,150.9 |

2,564.5 |

2,249.8 |

|

Net investment income |

171.9 |

653.5 |

539.0 |

|

Insurance benefits (net) |

–1,397.1 |

–1,878.1 |

–1,690.4 |

|

Benefit and loss ratio (after reinsurance) |

65.0 % |

73.2 % |

75.1 % |

|

Other operating expenses less reinsurance commission |

–440.6 |

383.9 |

340.6 |

|

Cost ratio (after reinsurance) |

20.5 % |

15.0 % |

15.1 % |

|

Profit/loss on ordinary activities |

–172.3 |

77.2 |

2.2 |

|

Net profit/loss |

–167.3 |

58.4 |

–2.1 |

|

Consolidated profit/loss |

–164.2 |

55.1 |

–16.8 |

Development of insurance benefits

Retained insurance benefits fell by 25.6 per cent to € 1,397.1 million in the year under review (2010: € 1,878.1 million) due to the decrease in payments for claims and the lower level of expenses for (deferred) profit participation. Accordingly, the benefit and loss ratio after reinsurance declined by 8.2 percentage points year-on-year to 65.0 per cent (2010: 73.2 per cent).

In Austria, insurance benefits fell by a substantial 26.7 per cent to € 852.0 million (2010: € 1,161.9 million). In Western Europe, insurance benefits decreased slightly by 8.7 per cent to € 381.9 million (2010: € 418.1 million), while the figure for Central and Eastern Europe declined by 45.2 per cent to € 163.3 million (2010: € 298.1 million).

Operating expenses

Total operating expenses in the life insurance segment less reinsurance commission and profit shares from reinsurance business ceded rose by 14.8 per cent to € 440.6 million in 2011 (2010: € 383.9 million). Acquisition costs increased by 13.4 per cent to € 344.8 million (2010: € 304.2 million). Other operating expenses also increased by 20.2 per cent to € 95.9 million (2010: € 79.7 million) due to the non-recurring expenses in connection with the Group’s repositioning. As a result of this development, the cost ratio in life insurance, i.e. the ratio of all operating expenses to Group premiums earned including the savings portion of unit- and index-linked life insurance (after reinsurance), rose to 20.5 per cent (2010: 15.0 per cent).

In Austria, operating expenses increased by 12.6 per cent to € 306.6 million (2010: € 272.3 million). The figure for the CEE region grew by 32.5 per cent to reach € 98.9 million (2010: € 74.6 million). On the other hand, operating expenses declined by 4.9 per cent in the Western European countries to total € 35.2 million (2010: 37.0 million).

Investment result

Net income from investments fell by 73.7 per cent to € 171.9 million in the year under review (2010: 653.5 million). Investments including the investments for unit- and index-linked life insurance decreased by 1.6 per cent to € 18,095.4 million in 2011 (2010: 18,397.2 million).

Profit/loss on ordinary activities, net profit/loss, consolidated profit/loss

The loss on ordinary activities in the life insurance segment deteriorated to minus € 172.3 million in 2011 (2010: profit of € 77.2 million). The net loss amounted to minus € 167.3 million (2010: net profit of € 58.4 million), while the consolidated loss after taxes and minority interests amounted to minus 164.2 million (2010: consolidated profit of € 55.1 million).