UNIQA’s roots go all the way back to the year 1811. Today, the UNIQA Group is one of the leading insurance groups in Austria and in Central and Eastern Europe (CEE).

With some 40 companies, we are represented in 19 countries. About 22,000 of our employees and exclusive sales partners look after around ten million customers. These customers place their trust in a strong partner that has its roots in Austria, but is at home throughout Central and Eastern Europe. We are the second largest insurance company in our home market, where we have a market share of over 21 per cent; in the fast-growing CEE region, we are among the top 5 in nine out of 15 markets. The UNIQA Group also includes insurance companies in Italy, Switzerland and Liechtenstein.

All types of insurance written

The UNIQA Group is a composite insurer offering its customers comprehensive products in property and casualty, life insurance, as well as health insurance. In UNIQA and Raiffeisen Versicherung AG, we have the two strongest insurance brands in Austria. In the CEE markets (with the exception of Russia), we work solely with the UNIQA brand – in line with our “one-brand-strategy”.

Our objective is profitable growth. We exploit the opportunities presented in our core insurance business in our key markets to continue the development of the UNIQA Group, building on one of UNIQA’s great strengths, namely closeness to its customers in the regions. We analyse the market and continuously develop innovative solutions for our customers.

The history of UNIQA goes back more than 200 years to the establishment of Salzburger Landes-Versicherung AG in 1811. Since then, the business has developed into a Europe-wide insurance provider. The first steps towards becoming an insurer outside of Austria were made in 1991, and we have operated under the UNIQA brand name since 1999. The head office relocated to the UNIQA Tower in Vienna in 2004.

Strong parent company and five segments

UNIQA Insurance Group AG is now the parent company in the UNIQA Group. It directs the Group, handles the indirect insurance business and provides services for the individual companies. The operating business is managed through the following five segments: UNIQA Österreich, Raiffeisen Versicherung AG, UNIQA International, Reinsurance, and Group Functions & Consolidation.

UNIQA Insurance Group AG was founded in 1999 and has been listed in the Austrian Traded Index (ATX), the leading index of Wiener Börse, since March 2014. The successful capital increase through a re-IPO in the autumn of 2013 increased the free float to 35.4 per cent. The Company’s major shareholders are Raiffeisen Zentralbank (Group) with 31.4 per cent and UNIQA Versicherungsverein Privatstiftung (Group) with 30.6 per cent.

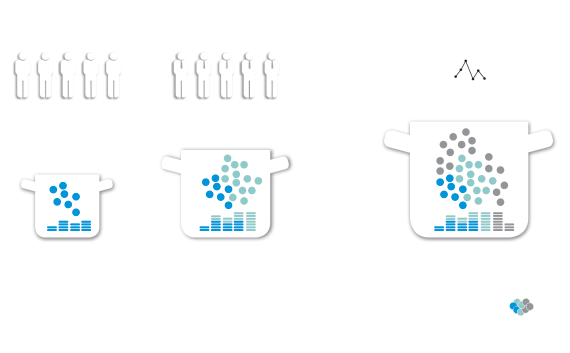

In short – the principle of insurance

|

Collective // Investors // |

Investment // Benefits / Expense / Dividends // |

1) Source: Insurance Association of Austria (2013)

The law of large numbers

|

When a policy is signed the insurance company bears the risk for the policyholder. In the case of an insured event, he then receives either a compensation payment or the agreed-upon benefits. In order to predict the claims and calculate the premiums we use actuarial methods. One important factor in this is the law of large numbers: The more similar but independent risks the insurance company has in its portfolio, the more precise its predictions can be. The assumption is that specific events will recur with a certain regularity. |