International stock markets recover

At the start of the year 2009, the international stock markets were still heavily affected by the financial crisis. The stock prices fell worldwide, often reaching historic lows. Added to this were regular negative reports on the economic data as well as pessimistic predictions by economic research institutes. Nevertheless, the influence of the economic stimulus packages and government guarantees started by various countries in 2008 led to a slight market recovery toward the end of the first quarter. This then continued as the US banks published surprisingly strong figures for the first quarter of 2009. Another important contribution to the recovery came in the form of good economic data, particularly from the USA and China, and multiple reductions to the prime rates by the European Central Bank (ECB) also had a positive effect on the stock markets. The fact that the US Federal Reserve has kept its prime rate almost at 0% since the end of 2008 also had a similar impact.

Good mid-year results from US companies – including many banks – and the statement by the Chairman of the Federal Reserve that the American economy had probably survived the recession noticeably rejuvenated the stock markets in the third quarter. Economic data from many different nations that exceeded expectations also contributed to this development, and the announcement that the ECB would make additional liquidity available brought further positive support. Toward the end of the year, the positive economic news spread, creating still more impulses.

To put it in numbers, the DJ EURO STOXX 50 that is representative of Europe grew by 16.9%, and the DAX also gained 19.8% in value. The European insurance stocks collected into the DJ EURO STOXX Insurance also exhibited a growth of 9.3%. In the Far East, the NIKKEI 225 exhibited a gain of 18.4%. Only in the USA were year-end losses to be seen. For instance, the DOW JONES INDUSTRIAL AVERAGE fell in value by 32.7% over the year 2009, the NASDAQ COMPOSITE declined by 13.1%.

Vienna Stock Exchange also recovers noticeably

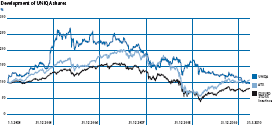

The Vienna Stock Exchange also gained significant ground in 2009. The leading index ATX (Austrian Traded Index) did fall back after a weak start to the year, reaching an annual low on 9 March of 1,455.95 points. This was followed, however, by a constant upward trend that reached an annual high of 2,752.39 points in mid-October – even with some volatility. After a slight consolidation, the ATX closed the year 2009 at 2,495.56 points, placing it 42.5% above the level at the end of the previous year. This places the index back at the level from the end of 2004. The market capitalisation of the Vienna Stock Exchange increased in an annual comparison by roughly €24 billion to €77 billion.

| (XLS:) Download Excel |

|

Information on UNIQA shares |

|

|

Securities abbreviation |

UQA |

|

Reuters |

UNIQ.VI |

|

Bloomberg |

UQA.AV |

|

ISIN |

AT0000821103 |

|

Market segment |

Prime market of the Vienna Stock Exchange |

|

Trade segment |

Official trading |

|

Indices |

ATXPrime, WBI |

|

Number of shares |

142,985,217 |

|

Standard & Poor’s rating |

A, stable outlook |

UNIQA shares relatively weak

The UNIQA shares listed on the prime market of the Vienna Stock Exchange were not able to keep pace with this development during the reporting period and exhibited a continuous decline over practically the entire year. This was only interrupted in mid-October by a slight upward movement during which the price recovered slightly to reach €14.63. After starting the year €18.20, the price reached its annual low on 18 September at €12.21 and finished the year at €12.97, leaving it 28.2% below the value at the end of 2008.