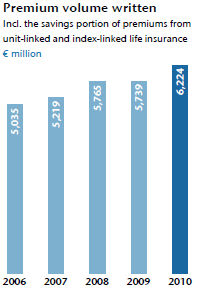

Taking into consideration the savings portion of the unit-linked and index-linked life insurance in the amount of €845 million (2009: €728 million), the total premium volume of the UNIQA Group increased in 2010 by a very pleasing 8.4% to € 6,224 million (2009: € 5,739 million), thus surpassing the € 6 billion mark for the first time. The total consolidated premiums written even grew by 7.3% to € 5,379 million (2009: € 5,012 million). Developments were very positive in the area of insurance policies with recurring premium payments in particular, which grew 5.2% to € 5,141 million (2009: 4,885 million). The single premium business grew even more robustly in 2010 with a 26.8% gain to € 1,084 million (2009: € 855 million). The Group premiums earned including the savings portion of the unit-linked and index-linked life insurance (after reinsurance) in the amount of € 823 million (2009: € 704 million) rose by 9.0% to € 5,964 million (2009: € 5,474 million). The retained premiums earned (according to IFRS) increased by 7.8% to € 5,141 million (2009: € 4,770 million).

In the 2010 financial year, 41.6% (2009: 42.6%) of the premium volume arose in property and casualty insurance, 15.6% (2009: 16.3%) in health insurance and 42.8% (2009: 41.1%) in life insurance.

In Austria, the premium volume written including the savings portion of unit-linked and index-linked life insurance increased in 2010 by 1.9% to €3,829 million (2009: € 3,756 million). Recurring premiums grew by 3.3% to € 3,447 million (2009: € 3,338 million). In contrast, single premium revenue fell by 8.9% to €381 million (2009: € 418 million). Including the savings portion of the unit-linked and index-linked life insurance, the premiums earned rose by 2.0% to €3,749 million (2009: € 3,674 million). The retained premiums earned (according to IFRS) in Austria amounted to € 3,100 million in 2010 (2009: € 3,074 million).

In the regions of Eastern and South Eastern Europe (CEE & EEM), the premium developments in 2010 were entirely positive and promising. The premium volume written including the savings portion from the unit-linked and index-linked life insurance fell in 2010 by 12.2% to € 1,294 million (2009: € 1,153 million). This put the share of Group premiums coming from CEE & EEM at 20.8% (2009: 20.1%). Recurring premiums grew by 12.8% to € 1,017 million (2009: € 902 million). The single premium business grew by 10.4% in these regions to €277 million (2009: € 251 million). Including the savings portion from the unit-linked and index-linked life insurance, the premiums earned decreased by 12.8% to €1,215 million (2009: €1,077 million). The retained premiums earned (according to IFRS) were € 1,120 million (2009: €1,002 million).

In the Western European countries (WEM) the premium volume written including the savings portion from the unit-linked and index-linked life insurance in 2010 rose by 32.6% to € 1,101 million (2009: € 830 million) primarily due to strong growth in the Italian life insurance business. Recurring premiums grew by 4.8% to € 676 million (2009: € 645 million). The rise in single premiums increased at a significantly more robust rate by achieving growth of 129.6% to €425 million (2009: € 185 million). Overall, the share in Group premiums therefore rose in 2010 to 17.7% (2009: 14.5%). Including the savings portion from the unit-linked and index-linked life insurance, the premiums earned decreased by 38.4% to € 1,001 million (2009: € 723 million). The retained premiums earned (according to IFRS) rose by 32.4% to €920 million (2009: € 695 million).