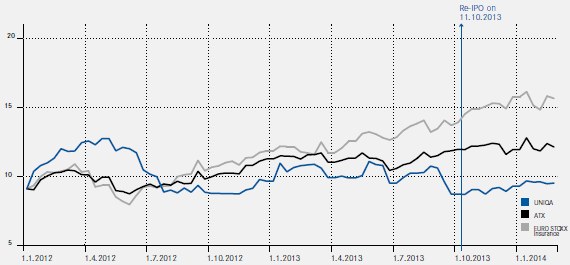

After opening at € 9.89 on 2 January 2013, the shares reached a high for the year of € 11.14 on 19 February 2013. The share price fell sharply following the announcement of the planned capital increase, recording a low for the year of € 8.12 on 2 October 2013.

The successful re-IPO marked the start of a steady upward trend, with the share price closing the year at € 9.28. The share price continued to rise in the first two months of 2014, climbing by a further 2.4 per cent to € 9.50. This meant that the UNIQA shares have achieved a performance of +11.8 per cent since the re-IPO in early October 2013.

Dividend distribution

We are committed to ensuring that UNIQA shareholders participate in the company’s success to an appropriate extent. We aim to distribute between 40 and 50 per cent of consolidated profit as a dividend. Based on the single-entity financial statements of UNIQA Insurance Group AG, the Management Board will therefore propose to the Annual General Meeting the payment of a dividend of € 0.35 per dividend-bearing share for the 2013 financial year.