Health insurance is a core competence of the UNIQA Group. It is characterised by stable contributions to earnings, long-term contracts, and a positive growth outlook.

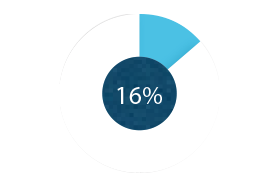

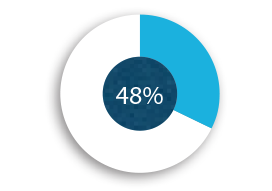

Health insurance, in terms of premiums, is the third-largest insurance line in the UNIQA Group. This insurance line includes voluntary health insurance for private customers, commercial preventive healthcare and opt-out offers for certain freelancers, such as lawyers, architects and chemists. In health insurance, we cleared just under €1.0 billion in premiums across the Group in 2014; this was about 16 per cent of total premium volume. We are the undisputed market leader in this line of insurance in Austria, with a 48 per cent market share. About 92 per cent of premiums come from Austria, with the remaining 8 per cent coming from international business.

Long-term and stable – health insurance

Total

|

Stable pillar // |

Austria

|

Market leaders // 1) Source: Insurance Association of Austria, Annual Report 2013 |

Fundamentals of health insurance

Private health insurance is a property/casualty insurance product. In Austria, however, it is calculated “as a type of life insurance.” This simply means that a policy reserve is set aside at the beginning of the policy term to finance benefits as they increase with age. Health insurance policies cannot be cancelled by the insurer. Because cost structures change over time, premiums are continuously adjusted.

About one-fifth of health insurance benefits go to stationary care (for example, premium category), around one-fifth to out-patient care and fixed-sum insurance products such as daily benefits for hospital stays. In Austria, the UNIQA Group also operates four private hospitals through the PremiQaMed Group, which is a wholly owned subsidiary of UNIQA Österreich Versicherungen AG.

Stable long-term business model

Health insurance is characterised by stable contributions to earnings, long-term contracts and a positive growth outlook. Premiums rise in line with the development of health costs and life expectancy. Because health insurance provisions are not transferrable in the event of a withdrawal, the rate of cancellations in this line is low.

Health insurance, unlike property insurance, is scarcely influenced by elemental events. However, the current low interest rate environment in Europe also poses a challenge to this line of insurance. Future regulatory changes could also have an effect on health insurance. UNIQA is active in the insurance association, working together with other insurance companies to counter negative developments.

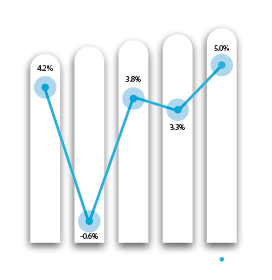

Development from 2010–2014

|

Steady growth // 1) Exclusive Mannheimer Group |

Focus on preventive healthcare

UNIQA strongly promotes prevention. We cooperate with leading companies in Austria in commercial health promotion. Some of our projects in this field include the UNIQA VitalTruck and the UNIQA HealthCare Truck, which toured through Austria as well as other countries such as Serbia and Montenegro in 2014. Since 2009, UNIQA VitalBilanz (“Vital Balance”) has been offering companies about 120 modules on fitness, nutrition, psychology, energy and the environment. We are working on expanding this programme, enhancing partnerships, and developing a Fitness Profile 2.0 for businesses.

The UNIQA VitalPlan also gives private customers in Austria a comprehensive range of preventive services, from supervision by VitalCoaches to a VitalCheck. Our MedPLUS 24service health hotline also offers a team of physicians to answer questions. We have also offered a three-level prevention plan since 2014 that can be associated with a premium healthcare plan. Because an active lifestyle has a positive effect on health, last spring we introduced the first health insurance tariff to the market that rewards health-conscious customers.

|

Health on wheels // |

3 to 5 per cent // |

25 years // |

90 years // |