Property and casualty insurance is growing steadily. Profitability is increasing, as can be seen for example in the combined ratio. UNIQA’s innovative solutions are strengthening its leading role in various areas and attracting new customers.

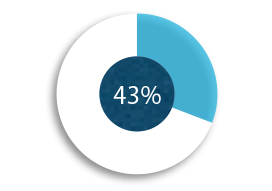

Property and casualty insurance, in terms of premiums, is the largest insurance line in the UNIQA Group. This insurance line covers property insurance for private persons and companies, as well as private casualty insurance. In property and casualty insurance, we cleared €2.6 billion in premiums across the Group in 2014; this was about 43 per cent of total premium volume.

Foundation for success – property and casualty insurance

Total

|

On a solid footing // |

CEE

|

Strong position // |

Fundamentals of property and casualty insurance

Property/casualty insurance covers needs arising from a loss. Examples of property insurance are fire insurance, comprehensive motor vehicle insurance, and liability insurance. The principle of meeting specific requirements applies here: the insurance benefit is determined by the insured sum, the insured value and the amount of the claim. In contrast, casualty insurance is a fixed-sum insurance product: the insurance benefit is precisely defined in advance.

The largest share by far in the volume of property and casualty insurance comes from the private customer business. Most property and casualty insurance policies are taken out at short notice, with a term of up to three years. Broad distribution across a great many customers and the relatively short duration of these products enables moderate capital requirements and makes this field of business attractive.

Profitability increased and combined ratio lowered

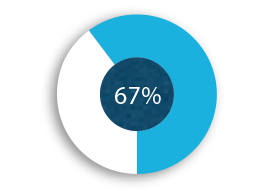

An important quantity for property and casualty insurance is the combined ratio: the relationship between insurance benefits and operating expenses as well as premiums. The lower this number is, the more profitable our business. Since the launch of our UNIQA 2.0 strategic programme, we have been working constantly on strengthening our operational profitability. We can see how successful our efforts have been in the improvement of the combined ratio, which we have been able to reduce every year since 2011. In 2014, we reached a combined ratio after reinsurance of 99.5 per cent for the Group, after 99.8 per cent in 2013, 101.3 per cent in 2012 and 104.9 per cent in 2011.

We were not able to fully attain our target for 2014 because of flooding in Southeastern Europe as well as major claims from small and medium-sized businesses. We are, however, well on our way to increasing operating profitability in property and casualty insurance even further: the UNIQA Group is aiming for a combined ratio of about 96 per cent beginning 2016.

Core business further improved

|

Combined ratio // |

Security and innovation

We are working constantly on innovations for the security of our customers. One example is SafeLine: this motor vehicle insurance, which is unique in Austria, came with a new, compact GPS box that includes a crash sensor in 2014. The emergency button is wireless and can be placed anywhere in the car. Another example is the UNIQA severe weather warning via text or e-mail, which we offer together with the UBIMET competence centre. This successful partnership was extended by six more years to 2020.

In 2014, we also added new components – for example, regarding advance directives and mediation – to legal expenses insurance and private home and flat insurance in Austria. We will conclude our revisions in commercial property insurance in 2015.

SafeLine for cars // |

Severe Weather Warning // |