UNIQA poistnova launched the first online

comprehensive insurance in Slovakia and is the top

online provider on the Slovakian market with an

additional three top products.

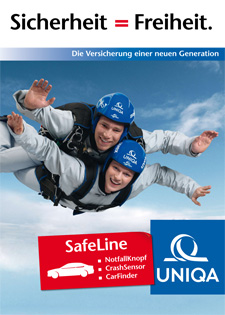

The innovative concept of SafeLine automobile insurance, introduced in 2007, has already proven itself and put UNIQA in a leading position in Europe. In the meantime, there is a clear trend in the direction of insurance telematics products in the large European markets. Over 35,000 customers have already chosen this attractive product. SafeLine is the first insurance product that can save lives. In addition to the insurance tariff, the package offers more security for the car and its passengers. SafeLine includes a GPS unit with a crash sensor that is invisibly installed in the car. In the event of a moderate to severe collision, this unit sends an alarm as well as the accident location to the dispatch centre (ÖAMTC, the Austrian Automobile Club). In addition, the CarFinder can locate and secure the vehicle after a theft. In several hundred responses after accidents, emergencies, breakdowns and thefts, SafeLine has helped UNIQA customers in wide-ranging ways.

SafeLine – the first insurance product that

can save lives – has put UNIQA in a

leadership role in the European markets.

The product also offers a few important financial advantages: Everyone – even heavy drivers – profits from better risk protection created by the safety discount on comprehensive and automotive casualty insurance. Light drivers receive an additional 25% environmental bonus on their liability and comprehensive premiums. The environmental bonus for light drivers begins at an annual kilometre count of under 15,000 km. Ultimately, the less the customer drives, the greater the environmental bonus.

In 2010, UNIQA also offered the “Free Weekend” campaign, which meant that kilometres driven on the weekend were not included in the valuation for one year. UNIQA thereby rewarded those customers who avoid driving their cars during the week, preferring to use their vehicle only on the weekend for family outings and shopping.

Furthermore, UNIQA remains the only insurance company on the Austrian market that protects drivers from major financial consequences after an accident in which they were partially or fully at fault. UNIQA driver protection offers an insurance coverage up to €1 million if others are not, or are only partially, obligated to pay damages or if the affected person’s social insurer does not pay or only partially pays for the damages. UNIQA thereby closes an insurance gap in the Austrian market, with benefits that cover living expenses, lost salary, care and treatment costs, compensation for pain and suffering, and burial costs. In 2010, driver protection was expanded to include two benefits: coverage of home remodelling costs up to €50,000 in the event of invalidity, and coverage of home help up to €5,000. Over 30,000 customers have already chosen this product component.

Since 2010, UNIQA has provided innovative leadership

by offering automobile insurance for electric vehicles.

The picture shows the first solar-powered car

insured by UNIQA.

For more comprehensive coverage for customers, there is an option in automobile liability insurance since 2010 to take out a policy for a blanket coverage amount of €20 million. At the same time, the “Auto & Network” campaign continues and accelerates: Since 1 March 2010, customers with an annual pass for public transportation in an Austrian town or city have received a voucher for three (previously: two) monthly premiums.

As an innovation leader, UNIQA recognised the societal trend towards electromobility and has been offering comprehensive and liability insurance for electric vehicles without official registration. This attractive product enables customers to insure e-bikes,

e-mountain-bikes, bikeboards or Segways.

SafeLine – safety and savings on premiums

- A GPS unit in the vehicle enables annual kilometres driven to be recorded and increases safety in an emergency

- A crash sensor detects moderate to severe accidents and automatically alerts the dispatch centre

- Emergency button for medical emergencies, flat tires and other threatening situations – message goes to dispatch centre

- CarFinder feature facilitates recovery after theft

- All safety services also work outside of Austria

- Environmentally friendly because it reduces CO2 emissions

- Premium depends on kilometres driven and street types

- NEW environmental bonus: an increase of the annual kilometre limits to 15,000 km is the first step of premium savings

Additional new developments in automobile insurance

- Expanded driver protection

- Savings on premiums with the “Free Weekend” and “Auto & Network” campaigns

- 10% savings on premiums for all environmentally friendly VW BlueMotion models

- New insurance for used cars and electric vehicles without official registration

- Blanket coverage liability insurance for vehicles increased to €20 million