Overall expansion strategy unchanged

Strong presence in Central, Eastern and

South Eastern Europe

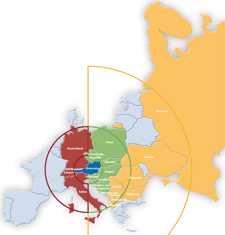

The strategic goal of the UNIQA Group is still to secure and expand its strong position in the Central and Eastern European markets even in times of hard competition. In this way, the Group seeks to remain successful on the nearly saturated markets in Austria and Central Europe while at the same time actively taking advantage of the high potential in the exceptionally dynamic region up to and and beyond the eastern border of the EU with its 360 million residents.

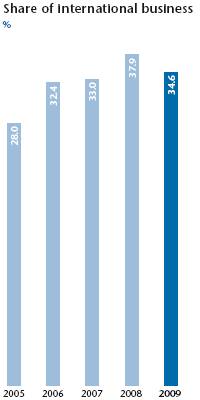

In view of the volatile market environment and the financial crisis, no medium-term forecasting of the results will be published until further notice. The UNIQA Group evaluates its internationalisation strategy based on the share of international premiums in the total volume, with a long-term target value of at least 50%. A significant portion of this should come from Eastern Europe. Concrete medium-term targets also exist for the respective, individual growth markets in Central, Eastern and South Eastern Europe of 5% to 7% in the non-life segments and 3% in life insurance.

Broad coverage in Central, Eastern and South Eastern Europe

In the last ten years, UNIQA has established itself as a key player in Central, Eastern and South Eastern Europe. The numbers speak for themselves: with over 40 insurance companies in a total of 21 markets, a premium revenue of €5.7 billion and capital investments of over €22 billion, UNIQA holds an impressive position in this interesting and rapidly growing region. The radius of action in South Eastern Europe has been successfully expanded in recent years to include Albania, Macedonia and Kosovo. At the same time, the Group has also further strengthened its position in these dynamic markets by increasing its financial commitment in Bulgaria and the Ukraine.

The most recent highlight of the expansion was the founding of Raiffeisen Life in Moscow in 2009. The employees of this company work with ZAO Raiffeisenbank to offer life insurance policies specially developed for the Russian market. Based on its full integration within the UNIQA Group, the newly founded company profits equally from the product and sales experience out of Austria as well as in the Central and Eastern European subsidiaries. The premium potential is exceptionally high – currently an annual average of only €183 in insurance premiums are paid per person by the 142 million residents of Russia. In Austria, this value is €1,935.

The position of the UNIQA Group in Central Europe has been strengthened during the reporting period by extending and intensifying the cooperation with the Veneto Banca Group in Italy. In this regard, the Milan-based subsidiary, UNIQA Previdenza, acquired 90% of the share capital of UNIQA Life S.p.A. The new, exclusive rights to the insurance sales cooperation with Veneto Banca are also linked to this company.

Differentiated internationalisation strategy

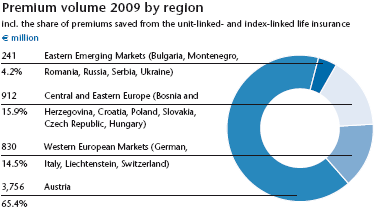

Due to the rising level of internationalisation, the share of premiums generated by the UNIQA Group from international business currently lies at 34.6%. The markets of Central, Eastern and South Eastern Europe contribute an increasingly large portion of the total Group premiums, currently at 20.1%. However, the exchange rates developed unfavourably for these regions in 2009. Roughly 14.5% of the Group premiums originated in the Western European markets in 2009. The increasingly pronounced diversification by regions, products and also sales channels has not only brought UNIQA a greater spread of risk, it also harbours additional potential for actually achieving the desired growth.

In the individual regions, the UNIQA Group pursues a distinct strategy that is tailored to the conditions and opportunities of the respective market. In Austria, UNIQA’s goal is to secure its strong position through segment-specific, qualitative growth with high returns. In the Western European markets, which already exhibit high insurance densities, the Group operates in profitable niches and relies on exclusive offers in individual sales channels as well as bank and broker sales. In Central, Eastern and South Eastern Europe, UNIQA is striving to optimise its financial commitment as well as to secure an increase in its market share as a composite insurer.

Dynamisation projects strengthening the expansion in CEE

A series of dynamisation projects in sales supports the strengthening and targeted expansion of the business in the new markets. UNIQA’s goal is to raise the respective market shares in the non-life sectors to 5% to 7% and in life insurance to 3%. The basis for this expanded market presence lies in a uniform, Group-wide brand and advertising concept, a shared sales policy and a coordinated approach to the areas of IT, human resources and leadership development.

Successful “Preferred Partnership” with Raiffeisen

One very important success factor for the penetration into the new insurance markets is the “Preferred Partnership” of the UNIQA Group with the Raiffeisen bank group with more than 15 million private customers. This cooperation now extends across 14 Eastern and South Eastern European countries that still lag significantly behind in both insurance and banking. Both partners profit from this cooperation, which also offers positive prospects for the future thanks to the expected above-average growth in the region. Since 2004, the first year of the cooperation, the jointly generated premium volume has risen to €270 million in the year 2009.

Financial support from the EBRD

Through support from the European Bank for Reconstruction and Development (EBRD), UNIQA has significantly higher funds at its disposal for minority participations by the EBRD in UNIQA companies in Central and Eastern Europe. As early as 2007, the EBRD increased the scope of its financial cooperation with us from €70 million to €150 million.