Established in 2003, the QualityPartnership remains appealing due to its attractive and innovative services to private customers. This well-received customer loyalty tool is responsible for acquiring more than 450,000 partnerships. The central elements of this QualityPartnership are exclusive customer service and complete transparency regarding all insurance policies and payment processes combined with an attractive portfolio of specific benefits and features. These include membership in the UNIQA VitalClub, Austria’s largest health programme, consultation through an Exclusive Representative, and the “no-claims bonus”. Customers can view every detail of all policies and transactions through their PartnerConto, the financial command centre for the overall customer relationship, as well as the customer portal, myUNIQA.at. Additionally, customers can collect valuable PartnerPoints and exchange them for attractive services. Furthermore, the range of services is being continuously expanded and improved. For 2011, a complete relaunch of the QualityPartnership is planned to expand this customer loyalty instrument.

Pioneer in exceptional assistance services

As a leader in innovative customer-tailored assistance, UNIQA is always expanding its range of services. For example, UNIQA offers the insurance and pension product Private Supreme in the area of health and pension, the active health maintenance programme VitalPlanPLUS, VitalClub with offerings and services pertaining to health, fitness and well-being, and CarePLUS nursing care insurance to satisfy the increasing demand for comprehensive care. In the area of nursing care insurance, the company supports its customers with comprehensive telephone advice on nursing care and helps coordinate and organise daily details associated with nursing care.

In terms of automobile-related products, the well-received product SafeLine and AutoPLUS24service also offer customers unique assistance services. Through a crash sensor, SafeLine offers immediate help in an accident, and the UNIQA CarFinder which is also linked to SafeLine helps customers find their car both within Austria and abroad if it has been stolen. AutoPLUS24 offers 14 services throughout Europe around the clock from towing to returning children home.

UNIQA has been offering fans of water sports an attractive service since June 2010: Wind forecasts and analyses, animated weather maps for all the lakes in Austria, water temperatures and the maximum UV exposure can be found on the new UNIQA sailing weather portal. For customers using cableways, UNIQA developed the successful concept of severe weather warnings and offered it to policyholders as a supplemental product. The cableway weather information system (SEWIS) offers precise information to cableways operators. This enables them, on the basis of precise weather forecasts, to economically and efficiently plan the allocation of resources when it snows.

In addition, the international service package introduced in 2007, the UNIQA Companion offers access to product-unrelated information regarding mobility, social issues, budgeting, health and lifestyle. The Companion Hotline can be consulted at 70 select service points in seven European countries or by telephone around the clock, 365 days of the year, even in the customer’s own native tongue. In 2010, UNIQA expanded its services in Austria with the new attorney portal which offers customers accelerated processing of claims with enhanced data security through more efficient and legally reliable communication between attorneys and insurance companies.

New services added to the UNIQA severe weather warning

Well-received by the market, the severe weather warning introduced in 2004 by UNIQA is a supplementary service for avoiding losses. In addition to Austria, this service has been introduced by subsidiaries in Hungary, Poland, the Czech Republic and Romania as well as recently Serbia, Montenegro and Croatia. With severe weather warnings via SMS and/or e-mail, the customers in the affected region are informed of threatening heavy rains, heavy snow, hail, freezing rain and storms. In the case of storm warnings, UNIQA also works together with Raiffeisen Versicherung to set up a free telephone hotline to ensure rapid assistance in event of storm damage. Customers also receive expert advice in insurance questions.

Due to the recurrent floods in the last years, UNIQA together with UBIMET, Austria’s largest private weather service, developed a flooding information system that informs local customers when the water levels threaten to get too high. Since 2010, the users of the UNIQA severe weather warning receive relevant flood warnings directly by SMS and/or e-mail. For the winter months, the warnings were expanded to road conditions to reduce the increased risk of accidents during the cold time of the year. In addition, UNIQA, Raiffeisen Versicherung and Sal

zburger Landes-Versicherung introduced a new service in 2010 which informs customers via SMS when there is a threat of local damage from heavy snow. Overall, more than 27 million warnings have been sent to approximately 370,000 private customers as well as 1,190 municipalities in Austria. In 2010 alone, more than 6 million messages were sent.

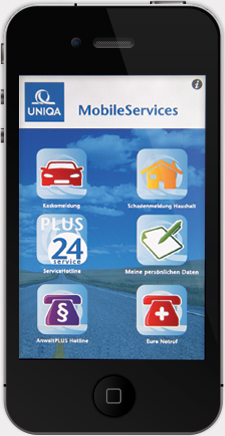

Exclusive service offers fast and easy

accident reporting using a smartphone.

The new applications for UNIQA Mobile

Services are available for customers to

download free of charge.

UNIQA goes apps

Since May 2010, the new UNIQA MobileServices enable customers with comprehensive car insurance to send damage reports directly from the accident site free of charge to UNIQA via an iPhone or Blackberry. Vehicle damage can be communicated easily by drawing a sketch on a touchscreen and supplemented with photographs of the accident site. In addition, the smartphone identifies the precise scene of the accident via GPS. The application also includes an emergency hotline which is available to customers by phone both within Austria and abroad. With this new app UNIQA is integrating the dynamic development of smartphone applications into its range of services, thereby enabling damage claims to be processed with a high degree of efficiency. Since November 2010, Raiffeisen has also been offering this service.

More than 5,000 customers with smartphones have downloaded the new service since May 2010. Given the increasing market penetration of smartphones, a substantial percentage of vehicle accidents will be able to be processed more quickly and efficiently for the customer with the new application. The innovative damage reports for customers with comprehensive vehicle insurance are only the first in a series of additional applications: In December 2010, UNIQA together with Raiffeisen Versicherung and Salzburger Landes-Versicherung started offering damage reports via smartphones for apartment and home insurance policies as well. UNIQA will be introducing additional mobile services in 2011.

The 2010 UNIQA VitalTruck Tour went to six Polish

cities to raise awareness with numerous activities of

active and healthy lifestyles. A highlight in Warsaw was

a visit by Bogdan Wenta, the trainer for Poland’s national

men‘s handball team and, since 2009, a popular UNIQA

representative. Over 300 visitors analysed the results of

their personal fitness test with the help of the

UNIQA VitalCoaches.

UNIQA VitalClub: Comprehensive health programme combined with lifestyle

In a response to increasing levels of stress and inactivity in many sectors of the population UNIQA, as the leading health insurance provider in Austria, initiated Austria’s largest health programme almost 20 years ago which has proved to be an effective customer loyalty instrument. The very well-received UNIQA VitalClub combines a broad portfolio of attractive offers covering exercise, nutrition and mental fitness.

UNIQA VitalCoaches function as holistic personal trainers and actively help individual customers keep and promote their health and vitality. A broad palette of activities and information are offered through the personal consultation services ranging from attractive VitalSeminars to the free UNIQA VitalEdition, a publication series providing comprehensive information and tips on health. Exclusive advantages for TopPartners are offered through the UNIQA VitalDay and the Vital Seminar Golf & Motivation. In 2010, marketing projects were added to the VitalClub to support sales and enhance customer loyalty.

At the body.check exhibit at the Vienna Technical Museum, the UNIQA VitalClub offered an attractive programme with motivating and active talks by UNIQA VitalCoaches and VitalClub experts. In addition to interactive online tools, visitors were able to take advantage of VitalCoaching and participate in activity units. VitalClub side events at the National Conference “Junge Wirtschaft” and at the UNIQA Ladies Golf Open were great successes.

For companies as well, UNIQA offers a total of 80 modules for promoting employee vitality and health at work. The most popular of these is the UNIQA VitalTruck, which operates under the motto of “The rolling fitness profile” to examine current personal fitness levels and provide corresponding, individual advice in matters of lifestyle and training. In 2010, the UNIQA VitalTruck parked in front of Saint Stephen’s Cathedral in Vienna, combining healthcare with historical monument preservation. The archdiocese of Vienna received 10 cents toward the preservation of this monument for every fitness point per employee which “rolled in” a total of €10,000. Overall, more than 33,000 Fitness Profiles have been created since the introduction of the UNIQA VitalTrucks.

UNIQA VitalCoaches are very popular on the

Web portal www.meduniqa.at. Given the

excellent reception, a second set of podcasts

is being offered with ski racer Stephan

Eberharter and actor Rudi Roubinek on

topics relating to fitness and health.

UNIQA HealthPortal – remain healthy by digital surfing

The Web portal www.meduniqa.at is setting new benchmarks based on the UNIQA corporate philosophy with content and numerous interactive highlights: For example, UNIQA VitalCoaches offer workout videos with participatory exercises. Customers can create and evaluate paths for running, biking and walking or search for doctors and consult drug and hospital evaluations. Given the excellent reception, a second set of podcasts was launched in June 2010 with amusing and informative tips by ski racer Stephan Eberharter and actor Rudi Roubinek on topics relating to fitness and health.

UNIQA ArtCercle – exclusive art appreciation for customers

Another high-level service is the UNIQA ArtCercle which gives customers exclusive glimpses into the art world in the form of previews or a look behind the curtains of exhibits while simultaneously furthering UNIQA’s leading position as an art insurer in Central Europe. In 2010, roughly 1,000 visitors participated in eight events of the UNIQA ArtCercle.

“Mein sicherer Vorteil” – Raiffeisen Versicherung’s customer and service programme

Attractive premium rebates and special services are offered by Raiffeisen Versicherung in its customer loyalty programme, “Mein sicherer Vorteil”, with over 180,000 regular customers. As soon as a customer has two branch-independent policies, he automatically becomes a preferred customer. Other exclusive advantages include the severe weather warning offered by UNIQA via SMS or e-mail, as well as a bonus granted when no claims are filed which can amount to 10% depending on the number of policies. The customer portal mein.raiffeisen.at/ELBA internet offers customers an overview of their policy data and informs them of special advantages such as economical hotel discounts.

After implementing a new, technically supported consultation tool and a new consultation approach in 2009 (the central focus was safety in the form of a “security check”), Raiffeisen Versicherung was well on the path of integrating smartphone applications into their line of services in 2010. Since November 2010, customers have been able to submit damage reports for comprehensive car insurance via their smartphone; they have also been able to submit damage reports for apartment and home insurance since December 2010.