“We have torn our strategy apart …

... and put it back together.”

Ladies and Gentlemen, dear Shareholders,

The year 2016, which we are presenting to you in this report, began intensely for both you and us: in January, we informed you that we would be changing the strategic direction of the third and last phase of UNIQA 2.0, our long-term strategy programme.

Andreas Brandstetter, 47

Andreas Brandstetter has acted as the CEO of the UNIQA Group since July 2011. Priorto that, he was a member of the Group Management Board since 2002, responsible for new markets, M&A and bank assurance. He did a degree in political science in Vienna and the US and holds an executive MBA from California State University. Before joining UNIQA he was the director of Raiffeisen’s EU office in Brussels.

There were two reasons for this: first, necessary investments of about €500 million in IT, digitalisation and innovation in the coming years, to help us be proactive when facing the challenges of the Internet age; and second, negative effects from thecurrent low-interest rate environment which are resulting in diminishing income from capital investments in general and from life insurance in particular.

The fact that in January, thanks to our strong capital position, we decided to affirm our plans to increase our dividends each year, despite these two short- and medium-term revenue-impacting effects, nevertheless did not assuage the concerns of many of our shareholders. Our share price went into a tailspin, down to an all-time low of €5.04 on 11 February 2016. Obviously we, myself included, did not manage to communicate the long-term, value-adding effects of our – admittedly high – investments in a persuasive and credible way.

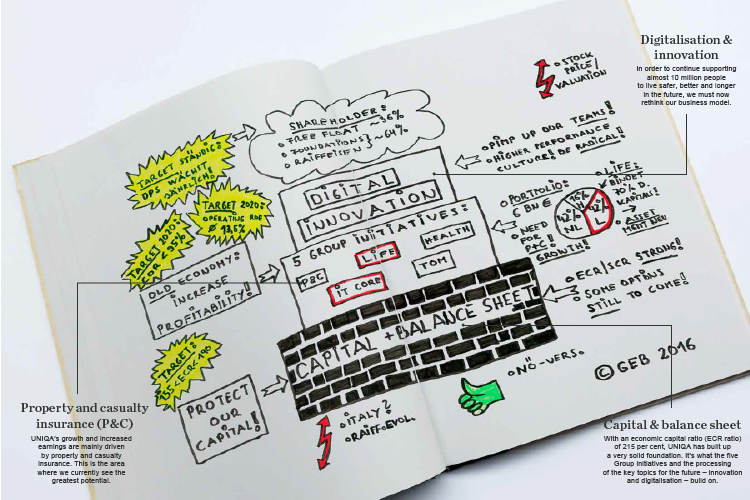

This disappointment on the capital market has of course given us a lot of worry. After an intense Group Management Board meeting at the end of August, during which we literally tore apart our strategy, in the form of a tabulated evaluation, and put it back together, we developed the picture of a house. A sketch of this “UNIQA House”, which we presented to the Supervisory Board in precisely this form in early September, is below. I would like to use this illustration to strengthen your trust in our company, or perhaps even win you over for the first time. Please take a few minutes of your time to think about my personal thoughts about this house.

The “UNIQA House”

Enlarge image

Our solid capital and our strongbalance sheet form the base of our house. The green thumbs below and next to the house symbolise measures that we use to strengthen our capital further, and red lightning bolts indicate those positions that may pose risks. We defused most of the lightning bolts in 2016, although particularly the decision to sell our Italian businesses was not easy to make.

The top priority for us is to defendour strong capital position, especially in the current unstable globalenvironment, and to be especiallycareful with it.

The first floor of our house represents our five Group initiatives. I have circled two of them in red,namely “Life” and “IT Core”, because these two projects representmajor investments and an intense allocation of resources. This meansthat they affect income in the shortterm – ours, and yours as our shareholders. That is all the more bitterfor “Life”, because in the current low-interest environment, about 42 per cent of our business volume(this value still contains business in Italy) ties up about 70 per cent of our risk capital without bringingin appreciable income (see also the portfolio graphic to the rightof the house).

What can we do about this, and what is our strategy for moving forward? We want

- to shed capital-intensive business in life insurance (Italy) or close it (Austria), instead promoting biometric life insurance; no experiments in life insurance asset investments, but a somewhat more aggressive spirit, for example in infrastructure investments;

- to keep health insurance at a high level of profitability, and

- to increase the earnings performance of property insurance (this did not happen in 2016 unfortunately, due primarily to developments in Poland) and to continue growing in a controlled way in this sector.

Above the portfolio circle, you’ll see “HR: Pimp up Our Teams” on the right side. This means that we have to and want to continue developing our organisational culture and how we work. Purely in terms of the structural organisation of our Group, this is relatively easy for us – the seamless merger of our four Austrian companies into the new, large UNIQA Österreich Versicherungen AG last year testifies to that. In terms of a performance culture, however, we have a few things to do if we want to develop a team of about 20,000 employees and exclusive sales partners into a state-of-the-art service provider and really work in a customer-centred way. This, more than anything else, personally gives me pause.

“Digitalisation is not a temporary fad; it will decide whether a company lives or dies in our industry.”

The second floor of our house is where innovation and digitalisation “live” – two eminently important subjects for our future. In 2016, we managed to cement the idea in the collective consciousness of all Group leadership that digitalisation is not a temporary fad; it will decide whether a company lives or dies in our industry. What we and many others in the insurance industry have not (yet) managed to do is short-term monetisation of this phenomenon, meaning to turn digitalisation into predictable income and profits. We are learning, training, bringing “digital natives” on board, investing time and money, starting to work cross-functionally, dealing with social media, investing in start-ups. We have great ideas one day that we often discard the next – yet neither our company nor our industry has ever truly had a relevant, radical innovation in its DNA. This is why we are still at the starting line. Our disadvantage is that we have to be particularly careful with the limited resources that we have, at least in comparison with our global peers. Our advantage is that we can work with more agility than some competitors and will certainlynot back down from this subject, because we want to win!

There was a change at the shareholder level in 2016, as you can see in our three major stakeholder groups in the top section of the sketch. The syndicate that has existed for 20 years between the Raiffeisen banking group, the UNIQA Versicherungsverein Privatstiftung (private foundation), and the Collegialität Versicherungsverein Privatstiftung (private foundation) remains unchanged, yet the ownership structure has shifted in favour of the foundations. From a company perspective, it is important that we continue our excellent sales partnership with Raiffeisen – both in CEE and in Austria (where our cooperation has already been extended until 2022). I am aware of the possible problems of my personal dual function as CEO of the UNIQA Group and Chairman of the Management Board of UNIQA Versicherungsverein Privatstiftung, so I will not occupy this dual position over the long term.

The red lightning bolt at the upper right – where you see “Stock Price” and “Valuation” – brings us back to the opening of this letter. It expresses the fact that we are gradually increasing the weak ROE of 2016 and thereby want to make our own contribution to a higher share price. Even though we are extremely well capitalised at the moment, we don’t want to do this by means of a special dividend (which would only be effective in the short term); instead, we would rather invest our capital carefully in the growth of our profitable core underwriting business. Just like our investment programme of over €500 million, we also want to embrace our long-term responsibility of managing a company that wants to please some ten million customers in 18 European countries. This is the basis of our declared intention to pay out dividends that increase in absolute terms every year – not fromthe substance of our company, but on the basis of growing income and sustainable cash flow.

On behalf of all of UNIQA’s employees, I would like to express our sincere gratitude to you for your interest in the UNIQA House. Even if the world in which the house stands is currently turbulent and complex, it gives me and my colleagues on the Management Board great pleasure to work for you every day, with enthusiasm and consistency.

Sincerely,

Andreas Brandstetter

CEO UNIQA Group