Capital position

The right resources for the job

For Kurt Svoboda, the Management Board member responsible for Finance and Risk Management, solid and balanced capital resources are just as important as the right equipment for a mountaineering trip: you have to have just the right amount in your rucksack – not too much, not too little – if you want to reach the summit.

“You wouldn’t take crampons and an ice axe to go hill-walking on the Hohe Wand, a popular excursion destination near Vienna, and on the other hand, running shoes are hardly the right choice for the Grossglockner, Austria’s highest mountain,” says Kurt Svoboda, opening the discussion with a vivid comparison. “We want to find the right balance between safety and freedom of movement.” The same applies to the UNIQA Group’s capital resources: they have to meet the stringent security requirements of an insurance company, yet at the same time also facilitate profits that are appropriate for this business model. UNIQA has made significant progress towards this goal in recent years, creating significant room for manoeuvre in the future.

So how can this improvement be measured? First of all, there is the capital ratio target according to Solvency II of at least 170 per cent, which UNIQA has more than met for two years now: in 2015, the capital ratio stood at 182 per cent, and in 2016 at 215 per cent. “In 2011, when we formulated our new Group strategy, we were still under 100 per cent. We’ve been able to make massive improvements,” says Svoboda. “At the same time, we have significantly improved the structure of our assets and thereby drastically reduced volatility. We learned our lessons from the Greece disaster of 2011.”

Optimisation of the capital structure along three themes

“By consistently streamlining the portfolio, the market risk of our capital assets has been reduced from more than 75 per cent to less than 65 per cent. That’s a good level. In addition, unlike some of our competitors, we do not view government bonds as risk-free. Instead, we accept an additional capital requirement of over €600 million.” At the end of 2016 the Italian business was sold off, as part of a renewed focus on the Group’s core activities. That will drive the capital ratio further up by about 20 percentage points.

Parallel to this, UNIQA has optimised its asset-liability management, meaning the fine-tuning of maturity structures for benefit obligations, especially from life insurance and investments. Kurt Svoboda: “Imagine if we had to pay out on an existing contract to a customer, for example next year, to the tune of €15,000, but the investment covering that benefit still had five years to go; these aspects have to be better coordinated. We have shifted our portfolio and changed the allocation of assets to individual insurance sectors. By doing this, we’ve managed to reduce significantly what’s called the ‘duration gap’ between assets and liabilities.”

Capital market issues were a third field of activity – a capital increase, the “re-IPO”, in the autumn of 2013 and two subordinated bonds in 2013 and 2015. “All issues were significantly oversubscribed, which just underlines our attractiveness for investors,” says Svoboda, emphasising the success of these transactions.

“We shouldn’t forget that this was only possible because of the foundation provided by a functioning and profitable core business,” says Svoboda. Even if UNIQA’s earnings performance in 2016 suffered somewhat from the low interest rate environment and the comprehensive investments we made for the future, significant improvement has been achieved over the years. Svoboda: “But there’s still some room for further improvement; in the medium term, we have even more demanding goals for the technical result. In other words, we continue to work tirelessly on optimisation of both the core business and the capital structure.”

Risk strategy

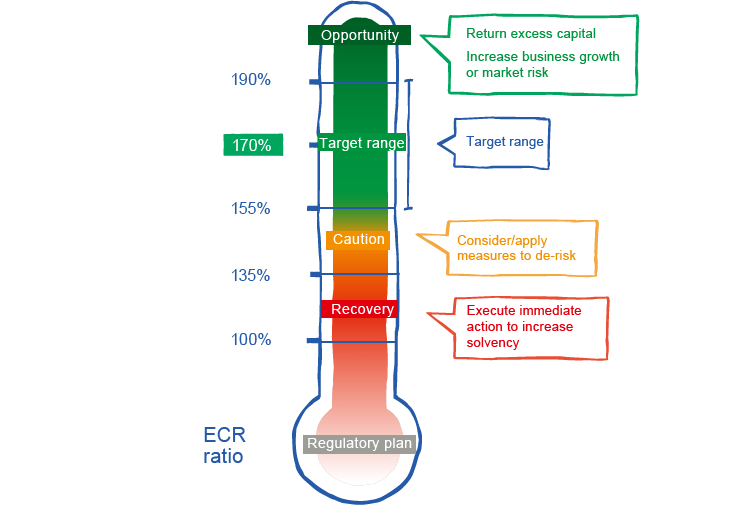

UNIQA defines the risk appetite on the basis of an economic capital model (ECM). The cover for quantifiable risks with eligible own funds – the economic capital ratio (ECR ratio) – should lie between 155 and 190 per cent, and the target is 170 per cent.

Advantages for all stakeholders

Of course, all of this is not an end initself. “All stakeholders benefit fromproperly dimensioned capital cover,”says Svoboda. “We can also offer our customers security by meeting our benefit commitments, even in economically difficult times. This also makes us a reliable, long-term counterpart for our sales partners.

The same applies to our role as an employer. At the same time, we are meeting the ever more complex, and sometimes excessive, requirements of the regulatory authorities. We also receive positive scores from the rating agencies, thanks to our sound capital positioning, which in turn has a favourable effect on the price of capital. And last but not least, our shareholders profit from a dividend yield that is 6 to 7 per cent above the industry average.”

Springboard into the future

But above all, he says, the way is clear for the future: building on a solid financial foundation, UNIQA will be able to address challenges such as increasing digitalisation and the low-interest environment, which Svoboda believes will continue for years, in a proactive way. “At the same time, we have sufficient latitude for investments, such as the investment program of €500 million which began in 2016. Of course merger and acquisition (M&A) activities are also conceivable, as long as the geographical footprint and the strategic fit are a match. Our solid capital structure makes us well-equipped for all of this. To return to my metaphor of the mountaineering tour: UNIQA should be able to climb any mountain with these resources.”

Kurt Svoboda, 50

Kurt Svoboda has been a member of the UNIQA Group Management Board since 2011 and has been responsible for UNIQA Austria and UNIQA International since 2016. Kurt Svoboda is currently the Chief Financial and Risk Officer. He studied business administration in Vienna and completed the International Management programme in St. Gallen. Kurt Svoboda began his career at KPMG in Vienna and built up experience at Wiener Städische and AXA.