Strong position in sales and service

Lots happening on the Eastern front

In Central and Eastern Europe (CEE) we are delighted to report not only solid growth, but also good potential for further development. Key success factors in the region include the strongly anchored UNIQA brand identity, a broad mix of sales channels, as well as our established partnership with Raiffeisen.

The UNIQA Group is represented in 15 countries in CEE. And with its diverse sales channels and strong branding, we are well placed in all these markets to participate in the overall upswing in the region. “We now serve more than six million customers in CEE”, Wolfgang Kindl, CEO of UNIQA International, outlines the importance of the Group’s international business.

Attractive long-term potential

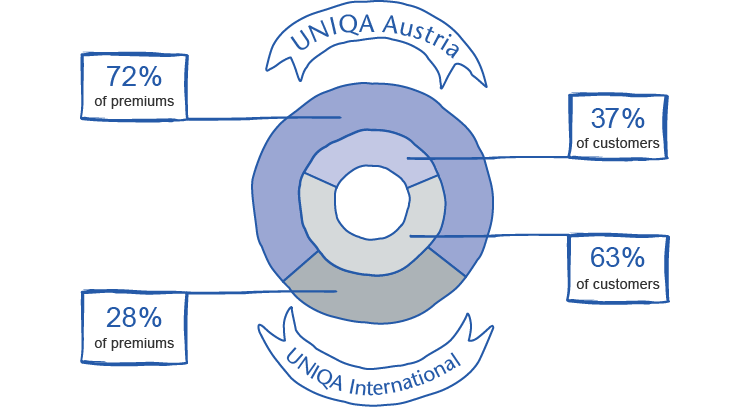

However, while two thirds of UNIQA customers live in CEE, only approximately one third of the Group’s premiums are currently generated from this region. “This isn’t necessarily a bad thing – quite the opposite, it represents an enormous market potential”, emphasises Kindl. “International studies and our experience show that insurance premiums in emerging markets are growing at a much faster rate than overall economic output. This should continue the catching-up process with Western Europe in terms of insurance density, as well as premiums per capita.”

Distribution of premiums and customers by core markets

The formula is as follows: when the overall economic situation improves, the demand for products beyond basic coverage also increases. In addition to motor vehicle liability insurance, there is also a growing demand for household and homeowners insurance, as well as products for personal protection such as accident and health insurance.

Rising insurance density

As a matter of fact, the CEE region, with its 160 million inhabitants, has experienced a noticeable economic recovery since 2016. Indicators such as increased employment, rising wages and increased registration of new vehicles should also bring growing prosperity and form the basis for an ever-growing demand for insurance benefits.

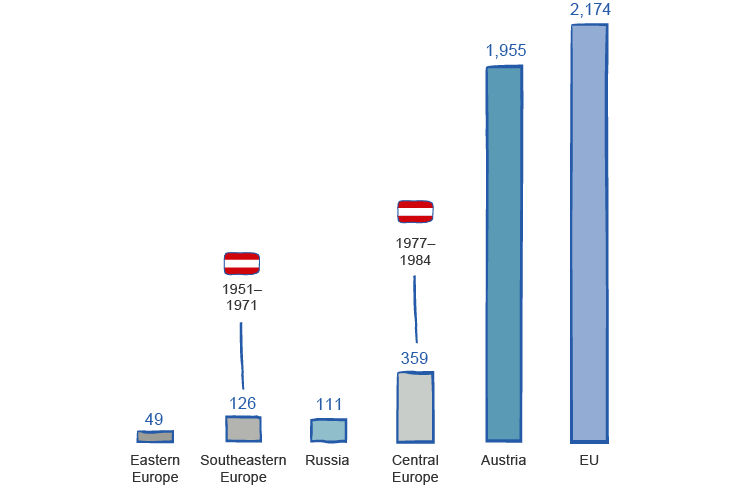

Currently in the 15 UNIQA CEE markets, the premium per capita per year is, on average, €150. In comparison, each Austrian citizen spends €1,995 per year on insurance. “In the more developed insurance markets in this region – Czech Republic, Hungary, Poland and Slovakia – the average is about €360, and in the medium term, the remaining CEE countries will also catch up to this level”, says Wolfgang Kindl confidently.

Strong growth in the last few years

The development in the past few years proves that this optimism isn’t unfounded. “In CEE alone, premium volumes have grown by more than 9 per cent in 2016 – and this after adjusting for exchange rates,” says Zoran Višnjić, Sales Director at UNIQA International. “In some key markets – Poland, Czech Republic, Slovakia and Romania – UNIQA achieved considerable success, partly through improved pricing in vehicle insurance and also due to double-digit growth in car sales.” While the competitive landscape remains challenging, “a certain consolidation effect can be observed in some CEE markets,” explains Višnjić.

Focus on non-life and accident insurance

Most of the business in the region is comprised of non-life and accident insurance; more than two thirds, followed by life insurance with 30 per cent. The medical insurance division plays a minor role, with only 3 per cent of the total premium income. Wolfgang Kindl: “Offering health insurance in CEE is seen above all as an investment in the future. This is because neither the infrastructure nor the legal framework is available here to the same extent as in Austria. We nevertheless have to start with basic products. In this way, we can build upon our experience as the market leader of this division in Austria.”

Combined women’s power in Southeastern Europe: UNIQA CEOs in Southeastern Europe – Saša Krbavac (Croatia), Senada Olevic´ (Bosnia and Herzegovina), Nela Belevic´ (Montenegro) and Gordana Bukumiric´ (Serbia) – in intensive discussion with Vinzenz Benedikt (head of Controlling at UNIQA International).

In some markets, there were difficult decisions to make in 2016 in the area of life insurance, in order to enable us to re-position UNIQA’s product range appropriately for the low interest rate environment. Thus the Group reduced the guaranteed discount interest rate for new business in many countries and discontinued the classic life insurance in favour of single-premium insurance. Having completed these measures in the second half of the year, the companies in the affected countries are now able to implement the next strategic steps and begin 2017 on a solid footing.

Wolfgang Kindl, 51

Wolfgang Kindl has been responsible for UNIQA International AG as CEO since 2011, before which he was managing director of UNIQA International. He was the CEO of UNIQA Assurances in Geneva from 2000 to 2004. Wolfgang Kindl has worked at the Group since 1996. The doctor of social and economic sciences began his career in sales. His degree focused primarily on insurance and personnel management.

Successful strategic partnership with Raiffeisen

An important strategic success factor for UNIQA is the long-term partnership with Raiffeisen, above all in CEE. Specifically, the cooperation with Raiffeisen Bank International (RBI) extends to 13 countries in CEE. In light of the past successes, this partnership was strengthened in 2013 by a consolidated, indefinite sales cooperation. Johannes Porak, Director of Banking Sales at UNIQA International, is satisfied with the result: “Thanks to this sales cooperation we can reach approximately 14 million Raiffeisen customers in CEE with our insurance solutions specifically tailored to the needs of the bank’s customers. The sale of our continuously expanding product range is mainly carried out through the more than 2,500 branches of RBI, as well as through alternative distribution methods such as call centres or digitally. We are convinced that through the joint development of the partnership, we will continue to take full advantage of our existing potential in the coming years.”

CEE: Great potential in health insurance

Faster digitalisation than in Western Europe

Though digitalisation is already causing massive changes in the domestic market in Austria, UNIQA expects even more significant effects in CEE. Wolfgang Kindl: “The transition to digital will be more pronounced in CEE because the insurance industry there does not have as long a tradition as it does in Austria.” In addition, the maturities of the policies in CEE are, on average, shorter than those in Western Europe, so that the disruptive replacement of the traditional business model can take place starting at a certain point in time without having too much of a detrimental effect. “This is particularly true for private customers, and, here in particular, the commodity sector with such products as, for example, simple vehicle and household insurance,” says Kindl. “In ten years, the new business models will become highly relevant in CEE. In Austria, the transformation will probably be somewhat slower.”

Johannes Porak, 56

Johannes Porak has been the UNIQA International AG Group Management Board member responsible for Bancassurance & Affinity in the international business since July 2011. He has worked at UNIQA since December 2000, prior to which he worked at the former Creditanstalt in Vienna and at J.P. Morgan Group in London. Johannes Porak has a degree in economics from Canterbury, England. He began his career at Coopers&Lybrand in his native Argentina.

And how does UNIQA International react to these challenges? “Through investment in online solutions and the development of new partnerships, UNIQA International continued to diversify its sales channels over the course of 2016,” says Wolfgang Kindl. “The primary objective here is to be market leaders in customer satisfaction. Although some independent studies already confirm UNIQA’s lead position in many markets, the Group continues to strive for ongoing improvement.”

High potential in CEE

(Insurance spending per capita and year in EUR)

Sustainable further growth

We continue to place an emphasis on developing our CEE business, while keeping an eye on the balance between growth in premiums on the one hand and costs and risks on the other. A balanced product portfolio and a good mix of sales channels form a robust foundation for this. Our committed and professional sales team, supported by strong back office staff and the strength of the UNIQA brand identity in the CEE region, are excellent ambassadors for us in this market.

Zoran Višnjić, 48

Zoran Višnjic´ has been the Group Management Board member at UNIQA International AG responsible for sales (not including banks) since 2011. Prior to this, he worked for five years as CEO of UNIQA Insurance in Belgrade. He worked as a manager in the banking and insurance sector in Canada for twelve years before moving to UNIQA. Zoran Višnjic´ holds degrees in economics from Belgrade and in finance (FRM, CFA) from Canada.

1) Market shares in Russia refer to life insurance only.